Mar 25, 2022

London Metal Exchange Sees Trader Exodus as Open Interest Slides

, Bloomberg News

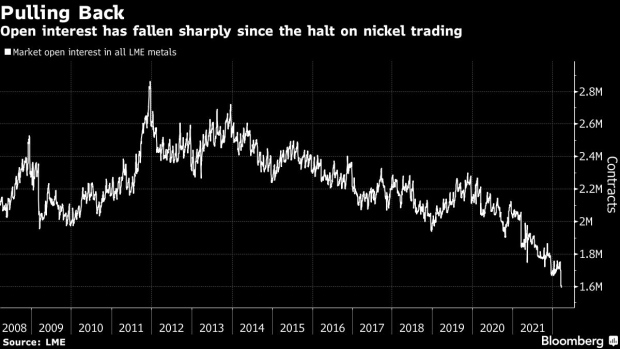

(Bloomberg) -- Traders and investors are rapidly cutting exposure to the London Metal Exchange after this month’s nickel-market chaos, driving open interest to a 15-year low and leaving key metals exposed to wild price swings as liquidity shrivels.

The number of open positions across the LME’s six main metals fell more than 8% in the two weeks after the exchange suspended trading in nickel and canceled billions of dollars worth of transactions on March 8. Investors have queued up to unwind their nickel positions since the market reopened, and the chaos has spilled over into other markets too, with aluminum and zinc exposure dropping sharply.

There are signs that open interest will drop further as investors and traders head for the exit, putting a further strain on liquidity in the benchmark futures market for industrial metals. The turmoil in the nickel market has angered many investors and several -- including both metals veterans and generalists -- have said they are pulling back from the LME.

Physical traders are also shifting their deals away from LME pricing where possible, according the people familiar with the matter. The move, which further threatens the LME’s central role in global metals markets, reduces traders’ need for hedges on the exchange that could then lead to big margin calls.

“With high levels of volatility across all LME metals, against a backdrop of geopolitical instability, open interest has fallen broadly in line with expectation, and is a trend that is evident across commodity markets,” the LME said in a statement.

To be sure, the trend isn’t limited to the LME, and there are signs of mass liquidation across commodities markets amid roiling price moves and severe constraints on financing. But traders and brokers with exposure to other markets say the aversion to trading on the LME has been heightened by its handling of the mayhem in nickel.

The LME suspended nickel trading and canceled transactions after prices soared 250% over two trading sessions, touching a record $101,365 a ton amid a short squeeze focused on China’s Tsingshan Holding Group Co. Following a weeklong suspension and a faltering effort to reopen the market, prices then plunged amid thin volumes, with many previously bullish investors enduring sharp drops as they waited to unwind their positions.

About 31,000 nickel contracts were liquidated between March 8 and March 22, driving open interest to the lowest since 2013. At Wednesday’s three-month closing price, they would have been worth roughly $6 billion.

In China, traders are unwinding positions they had built to bet on the arbitrage between the Shanghai and London markets, according to one Chinese metals trader, who said no-one he’s spoken to there is still trading LME nickel.

Still, while investors are pulling back from the exchange, volumes from industrial users and physical traders may prove more resilient, given that many hedgers have few alternative exchanges they can use.

“People want to trade and they need to trade, but it’s just a very difficult environment,” Michael Widmer, head of metals research at Bank of America Corp., said by phone from London. “If there was a competing contract on a peer exchange, we could see trading migrating over to it, but we’re not there yet.”

©2022 Bloomberg L.P.