Aug 17, 2022

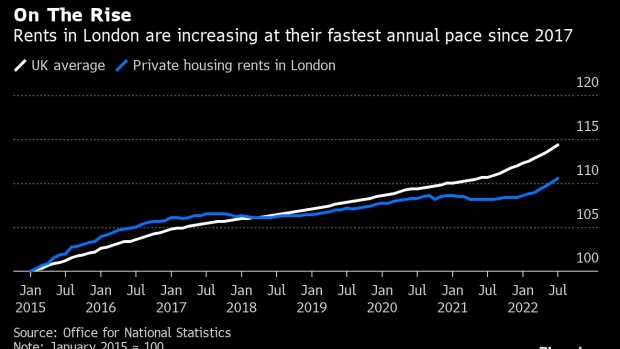

London Rents Spike the Most Since 2017 After Supply Shortage

, Bloomberg News

(Bloomberg) --

London rents rose the most in about five years as demand for rentals continued to exceed the supply of properties, exacerbating cost-of-living pressures on tenants in one of the world’s priciest capitals.

Private rental prices in London grew 2.1% in the year to July. While that’s the lowest in England, the capital is quickly catching up with an acceleration in rents charged since the start of the year, according to the Office for National Statistics.

The figures add to the gloomy outlook for London and British households more broadly, which are are bracing for a surge in energy bills in October. Inflation across the UK reached 10.1% last month, the strongest in 40 years, and real wages are falling at the sharpest pace on record.

The London rent price rally is fueled by a lack of new properties coming to the market. Foxtons said letting agents are seeing 40% fewer new listings compared with this time last year

The picture for newcomers or Londoners looking to move houses is even more dire than suggested by the ONS numbers, which include contract renewals.

Average prices for new rents stood at £541 per week in July, “hot on the heels of June’s £549 per week, which broke the record as highest monthly rental price in years,” according to Sarah Tonkinson, managing director at Foxtons.

It might get worse. Some Landlords are now considering selling their properties, Allan Fuller of Allan Fuller Estate Agents said in a survey by the Royal Institution of Chartered Surveyors. That’s due to changes in legislation, including scrapping the ability of landlords to evict tenants at short notice.

“As low stock and high demand are likely to continue for some time, we do not see average rental prices declining significantly in the coming months,” said Tonkinson.

Read more:

- UK Inflation Hits Double Digits for the First Time in 40 Years

- Britain’s Poorest Households Hit Hardest by Surge in Inflation

- UK Real Wages are Falling at Their Fastest Pace on Record: Chart

©2022 Bloomberg L.P.