(Bloomberg) -- The launch of London’s newest luxury apartment complex went virtual for the Covid-era, as a Netflix-style film promised an unrivaled lifestyle on the edge of Hyde Park complete with a restaurant, well-being floor and 60 million pound ($84 million) penthouse suite.

While the 14-minute clip portrayed London as a truly global playground for millionaires, it didn’t mention one of the capital’s current snags: few foreign investors are visiting under restrictions that have just been extended. That means the luxury market is largely relying on locals, and its long-awaited recovery remains elusive without wealthy offshore buyers to bid up prices.

“We’d ideally expect a lot of them on the ground right now -- but we’re just not seeing that,” said James Van Den Heule, a director at Park Modern developer Fenton Whelan, who says that U.K. buyers are currently the most common. “Particularly at this price level, quite a lot of people will want to actually be here to make the decision, so I do think that will put upward pressure on prices when they start to arrive.”

Sellers of the priciest properties had been looking forward to the summer, after Prime Minister Boris Johnson chose June 21 as the likely day that all Covid restrictions would be lifted, and with the U.K.’s reopening the return of Chinese and Middle Eastern money. But their hopes were dealt a blow last week when the government delayed the easing by at least a month as the highly infectious Delta variant drives up Covid cases across the country.

Owners appear to have given up waiting for an overseas savior. Homes in the wealthiest areas of London are selling at the fastest rate in seven years, according to LonRes data -- but that’s not translating into higher prices. Prime values in May were 1.9% lower than a year earlier.

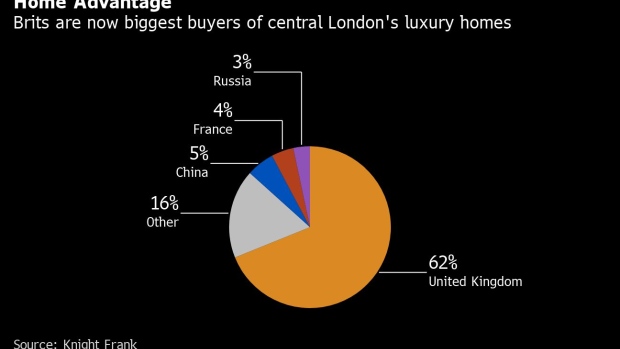

And it’s Brits who are driving the market, with the portion of U.K. buyers currently at 62%, the highest in at least a decade, Knight Frank numbers show. That suggests the locals are standing firm: they can’t or won’t pay the sky-high amounts that global heavy-hitters have pitched in the past.

That kind of stubbornness is a rarity in the wider U.K. residential market, where annual growth has soared to double digits as buyers scramble to beat an expiring tax break and upgrade their home. The surge even prompted the Bank of England to recently warn that the market was ‘on fire’ and feeding social inequality.

Locals might have a narrow window of opportunity. Prime central London values are forecast to rebound 7% in 2022 as restrictions are lifted, eventually returning to their peak in about five years, estimate brokers Savills and Knight Frank. To be sure, we’ve been here before -- the same firms predicted that the market had almost bottomed out in 2016 after the Brexit vote and that values would then climb through 2021.

“Every time we think things are going to change, there’s another variant and things are reviewed,” said Mark Pollack, sales director and co-founder of luxury estate agent Aston Chase. As a result, “in prime central London, with properties that ordinarily would attract an international market, for vendors who are under pressure to sell I think there potentially are some deals to be done.”

Cashed-up buyers have been taking advantage. In St. John’s Wood, known for Lord’s Cricket Ground and its tree-lined streets, a hedge fund manager was recently able to hammer the asking price for a three-story gated mansion down to 8.4 million pounds from 12.75 million pounds. The owner had been trying to sell since 2017, according to high-end property agent Jo Eccles, who arranged the sale at the end of last year.

As pandemic-wary wealthier buyers seek to upgrade their space, their wish-lists keep on growing: Homes with five or more bedrooms, a bigger garden, two studies and a room with enough space for a yoga mat and a Peloton bike have seen intense demand, says Eccles. Many of her clients are banking on a future of flexible working.

Owners of London’s luxury homes have become more motivated following seven years of price slumps and stagnation. Since the market’s peak in 2014, a series of tax hikes, the uncertainty after Brexit and measures to crack down on money laundering have combined to hit demand. The rise in sterling over the past year hasn’t helped either.

Still, overseas enquiries have been slowly ticking up in recent months, says Chris Jones, founding director for property consultant Warnerheath. But in terms of actually coming to London and sealing deals, “summer is optimistic, autumn is much more hopeful,” said Jones. One of his clients even said he expects to hold off from buying a London pad until the spring of 2022.

For some sellers, the pandemic has hammered home that life is just too short. Some people are pricing their houses competitively just so they can go ahead with planned lifestyle changes, says Eccles.

For those home owners, “it’s not about trying to time the market, it’s just about moving on with life,” she said.

©2021 Bloomberg L.P.