May 16, 2019

Longest pound slide since 2000 shows Brexit respite all but over

, Bloomberg News

The pound headed for the longest losing streak against the euro since the turn of the century as rising U.K. political risks fanned concern about the nation’s ability to achieve an orderly Brexit.

Sterling fell for the ninth day against Europe’s single currency, with Prime Minister Theresa May facing renewed calls from party colleagues to step down just as she prepares to take her Brexit deal to Parliament again. It dropped for the fifth day to a three-month low versus the dollar as global investor sentiment was weakened amid an escalating U.S.-China trade conflict.

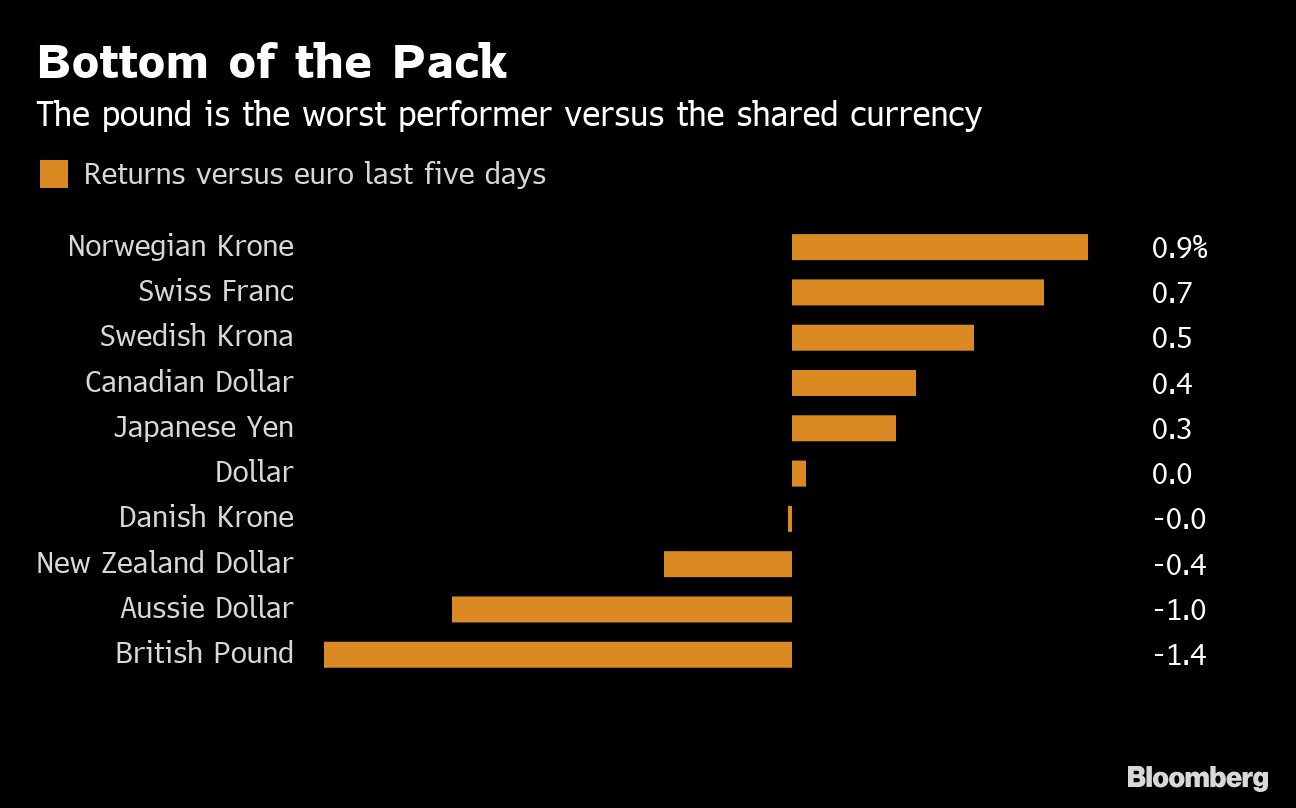

The pound led the past week’s losses among major currencies, with the latest challenge to May’s leadership raising risks she will be replaced by a hardline Brexiteer who could take Britain out of the European Union without a deal.

The reasons for the pound’s weakness is “a rough 50/50 split” between the U.S.-China tensions “and then the other half the Brexit developments,” said Jordan Rochester, a currency strategist at Nomura International Plc. “The timeline of Theresa May’s departure is much closer now.”

The pound outperformed its Group-of-10 peers in the first four months of the year as Britain secured an extension to the Brexit deadline, but has pared the gains since as the U.K. government has so far made little progress toward resolving the deadlock. May announced this week that she will put her Brexit deal back to a vote in Parliament in the week of June 3, but it’s not clear she would have the support she needs.

Sterling fell 0.3 per cent versus the euro to 87.43 pence per euro, heading for the longest run of declines since December 2000. Against the dollar, it slipped by as much as 0.2 per cent to US$1.2821, the lowest level since Feb. 15.