Oct 28, 2019

Loonie vies for G10 currency crown ahead of Bank of Canada decision

, Bloomberg News

Here’s how the loonie may react to BoC and Fed rate decisions

When the Canadian and U.S. central banks announce policy decisions on Oct. 30, traders are betting that the divergent decisions will allow the loonie to blunt the dollar’s status as the highest yielding Group-of-10 currency.

Futures traders are pricing in almost no probability of a rate cut at the Bank of Canada meeting, while predicting a quarter point reduction from the Federal Reserve. The U.S. central bank has already cut rates twice this year compared to the BOC, which has yet to cut rates since 2015.

The Fed’s easing is “chipping away at the key element that has provided underlying dollar support, which is that the U.S. has had a substantial carry advantage over pretty much all the G-10 currencies,” said Alan Ruskin, chief international strategist at Deutsche Bank. He expects the BoC to hold rates steady at this meeting, helping maintain the loonie’s strength.

Rate cuts generally push yields lower as will likely be the case in the U.S. Wednesday and correspondingly make Canadian assets look more attractive.

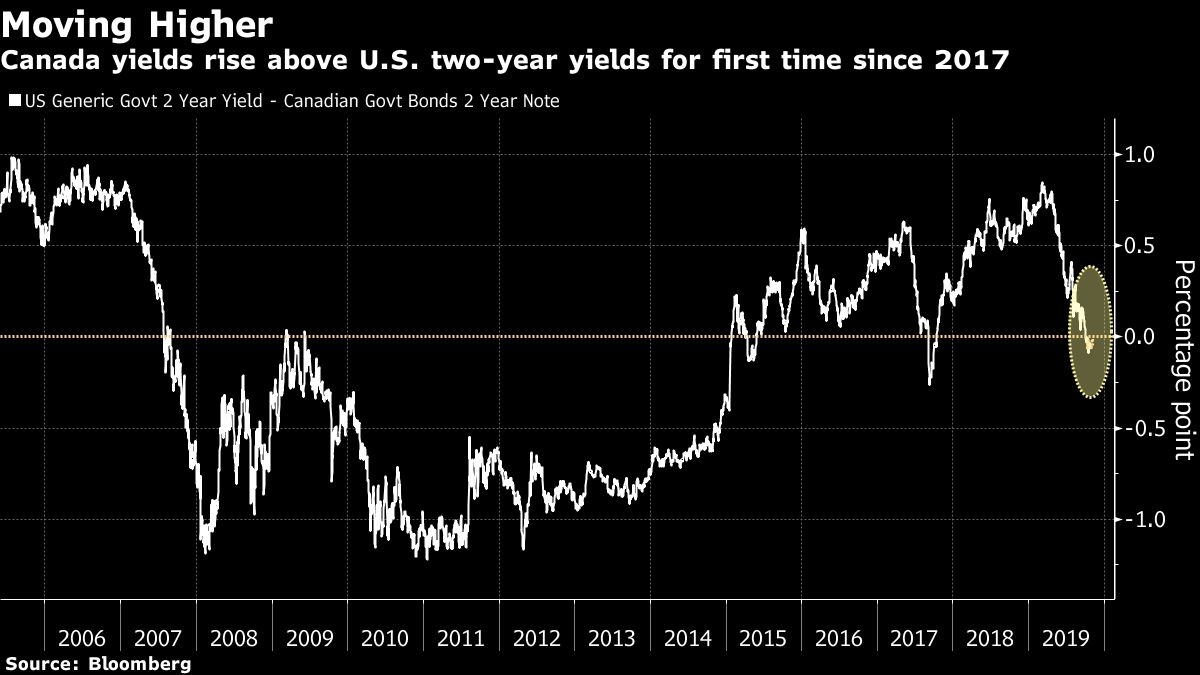

Canada’s two-year yields climbed above U.S. equivalents earlier this month for the first time since 2017 and loonie bulls are betting that they may have more room to run. The yields are about three basis points higher than U.S. equivalents, amid a flurry of soft U.S. economic data, which pressured Treasury rates lower.

The U.S. has consistently had the highest yields among G-10 currencies in both shorter-term and longer-term government debt for much of the last two years.

And while the U.S. 10-year yields are still higher than their Canadian counterparts, that gap has narrowed rapidly over the past year. It has tightened to about 25 basis points, the narrowest spread in two years, from a high of 89 basis points in March.

The Canadian dollar is the best performer this year in the G-10 with a 4.4 per cent gain against the greenback. Norway rounds out the top three highest-yielding currencies this year.

Wider Spreads

For Andrew Pyle, portfolio manager at Scotia Wealth Management, the Bank of Canada will remain on hold Wednesday and its policy language could turn hawkish, which is likely to pressure Canadian bond yields higher and widen their spread against U.S. equivalents.

The wider U.S.-Canada spreads will attract flows and may send the loonie toward the top end of its recent range, he said. Pyle is buying Canadian bonds and cutting back on U.S. notes.

Should the economic data turn, the strength of the loonie could be short lived, Pyle said.

Others are not convinced that the loonie will extend gains.

“Even though it’s been one of the best performing currencies to now, to be long the CAD and have a significant bullish view on it, has to have as an underlying assumption that the U.S. economy is going to remain very resilient,” said Francesca Fornasari, head of currency solutions at Insight Investment, which has $844 billion in assets under management.

“The direction of travel has been toward softer data, rather than stronger data” in the U.S., she added. She is neutral on the Canadian dollar despite the big jump this year.

The loonie is trading close to a three-month high against the greenback after posting a third straight weekly gain. Traders are wagering that while more spending under another term for Prime Minister Justin Trudeau’s Liberal party will bring higher deficits, it will also support growth and likely strengthen the Canadian dollar’s resilience.

“If the Federal Reserve does bow to market expectations of a rate cut, the loonie would become the highest yielding G-10 currency,” said Simon Harvey, FX market analyst at Monex Europe Ltd, referring to the two-year maturity. “The October 30th decision will be important for the USD/CAD cross. We expect the loonie to begin to make a sustained break below the $1.30 barrier just at the end of the month.”