Dec 6, 2018

Louisiana Offshore Port Ships Most Oil Ever on Supertankers

, Bloomberg News

(Bloomberg) -- The Louisiana Offshore Oil Port is pushing out the most crude it’s shipped in any one month since the terminal began supertanker exports in February.

As the race to build new supertanker ports in the U.S. intensifies, LOOP this week is poised to send out three Very Large Crude Carriers, or VLCCs, carrying 6 million barrels of crude bound for overseas, according to a person familiar with the matter. And more VLCCs are set to load later this month.

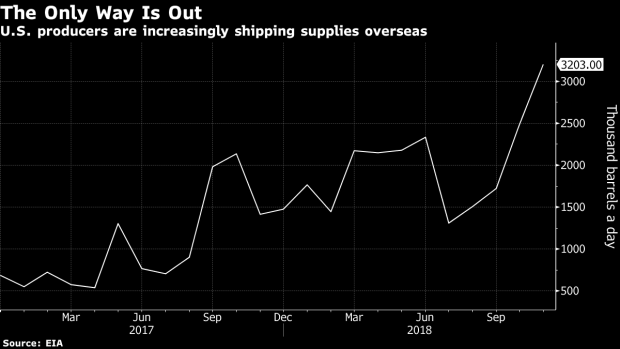

The boost comes as the U.S. turns into a net oil exporter for the first time in 75 years, having shipped a record volume of American crude overseas last week, according to the Energy Information Administration.

While nine new deepwater terminals are planned for Texas and Louisiana, most won’t start up until at least the end of 2019. Until then, LOOP -- the only terminal able to fully load the biggest ships -- will dominate the field. LOOP’s ability to handle VLCCs could help the U.S. exceed 3 million barrels a day by this time next year, said Andy Lipow, president of Lipow Oil Associates.

Exports have reached that level only twice since the export ban ended in 2015.

Still, loading VLCCs is new for the terminal, which until recently only handled crude imports. LOOP has spent the past several months working out the details of sending barrels from its onshore storage caverns to awaiting tankers, according to Lipow. By now, exports are being driven not only by the facility’s owners -- Marathon Pipeline LLC, Valero Terminalling & Distribution Co and Shell Oil Co -- but also by third-party companies.

Learning Curve

To be sure, the dramatic rise in LOOP exports this month could be a fluke caused by fewer incoming tankers. "LOOP takes incoming cargoes. If there are fewer imports coming in, they can load up more outgoing tankers," ESAI analyst Elisabeth Murphy said by phone from Boston.

LOOP exports may not be able to rise much higher as the majority of incremental American supply comes from the Eagle Ford and Permian Basin and those barrels leave from Texas.

But the terminal’s shipments could increase dramatically if plans to reverse the Marathon-operated Capline pipeline -- which ships oil from the U.S. Gulf Coast to buyers in the north -- proceeds, Lipow said. "With a reversed Capline, it would increase exports by 200,000-300,000 barrels a day out of the Louisiana."

(Updated with information about U.S. net exports in third paragraph.)

To contact the reporter on this story: Sheela Tobben in New York at vtobben@bloomberg.net

To contact the editors responsible for this story: David Marino at dmarino4@bloomberg.net, Catherine Traywick, Reg Gale

©2018 Bloomberg L.P.