Sep 15, 2022

Low Volatility ETF for New Stock Era Dodges Chaos With Weekly Rebalance

, Bloomberg News

(Bloomberg) -- Just in time for this week’s stock turmoil, the latest low-volatility product launched on Tuesday -- offering to navigate big market shifts faster than its rivals in this need-for-speed era on Wall Street.

The THOR Low Volatility ETF (ticker THLV) is betting on an accelerated rebalance schedule to help it stand out in the crowded corner of the exchange-traded fund industry that seeks to protect investors from wild equity moves.

While the biggest product in the space -- the $28 billion iShares MSCI USA Min Vol Factor ETF (USMV) -- reshuffles just twice a year, THLV will tweak its holdings weekly.

“That’s very frequent,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “If you’re launching in a category that’s this crowded, and you’re not dirt cheap, you need something different -- and this is it.”

Low-volatility ETFs have mostly been adding cash this year as investors hunt for safety in inflation-lashed markets. They’re part of a $1.5 trillion category known as smart-beta funds that deploy quant-inspired, rules-based strategies in an easy-to-access vehicle.

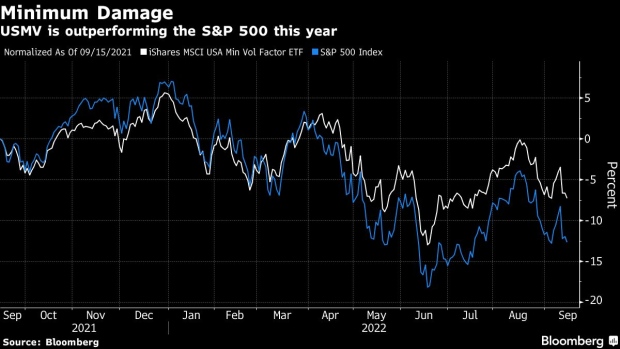

The idea is that by targeting stocks that don’t move around too much, they can outperform in a selloff. For instance USMV has fallen 12% in 2022 so far, compared with a drop of 17% for the S&P 500. Another fund, the Invesco S&P 500 Low Volatility ETF (SPLV) -- which reshuffles quarterly -- has dipped 8%.

As with many quant and smart-beta styles, low-volatility strategies are intended to work over the long term. Typically they follow indexes with infrequent rebalance schedules that minimizes disruption to the strategy and costs to the fund. However, that can make them slow to react to rapid market shifts.

Read more: Quant ETF Set for Record 75% Rebalance as Tech Stocks Plunge

THLV may be able to maintain more “purity” to the low-volatility characteristic by kicking out stocks that suddenly increase in volatility, Balchunas said. The risk is it increases the chances of getting a capital gains distribution because of the high level of stock turnover, he said.

The weekly reshuffle of the ETF is designed to ensure it can be more tax efficient relative to other investing vehicles, according to Brad Roth, chief investment officer at issuer Thor Financial Technologies. He said the firm already offers this low-volatility strategy for clients in separately managed accounts, but with an even-faster rebalance -- in real time.

“We wanted to keep the frequency at a spot to be able to maintain the nimbleness, but also not too frequently that we lose the tax efficiency,” he said.

©2022 Bloomberg L.P.