Nov 17, 2021

Lowe's raises sales forecast as home improvement booms

, Bloomberg News

Lowe’s Cos. raised its sales forecast for this year and reported stronger-than-expected revenue, the latest sign that home-improvement spending is outlasting the pandemic amid climbing U.S. home prices.

The company anticipates 2021 revenue of about US$95 billion, according to a statement Wednesday, up from prior guidance of US$92 billion. Lowe’s also predicted improvement in its gross-margin rate while acknowledging that the business environment “remains uncertain.”

Chief Executive Officer Marvin Ellison said a slate of housing trends, such as low mortgage rates and a mass of older houses, are good signs for his business.

“In the U.S., roughly 40 per cent to 50 per cent of our homes are 40 years or older. That bodes really well for home improvement and supply-demand for housing remains strong,” Ellison said in an interview.

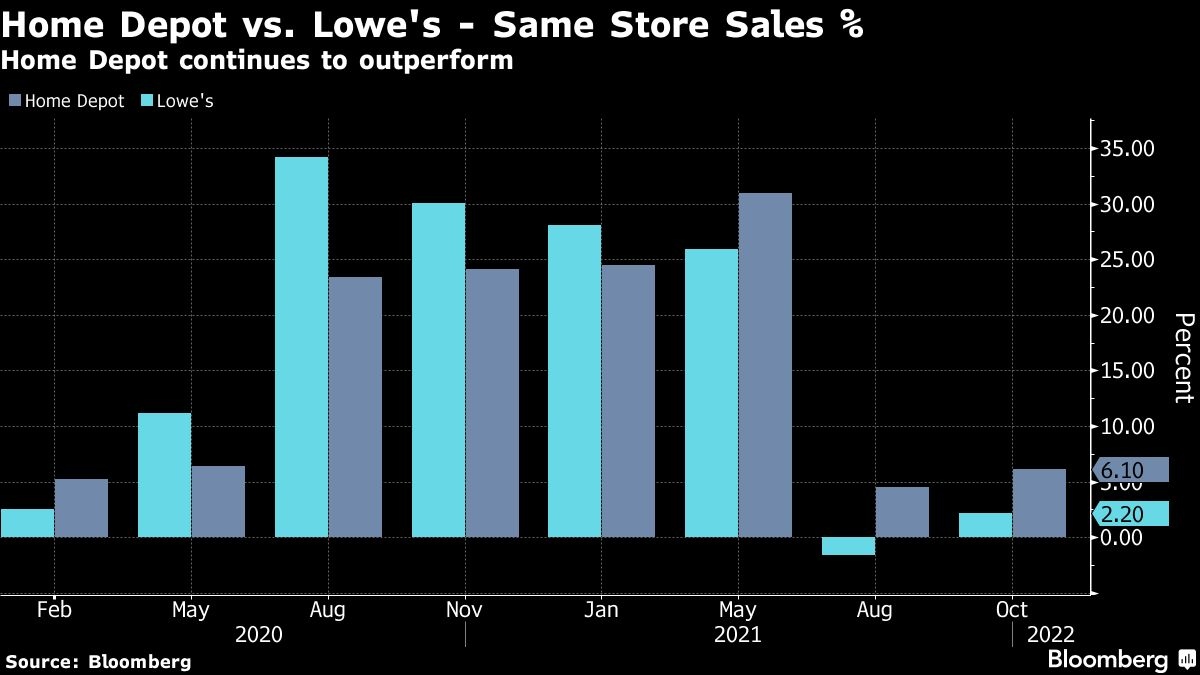

The improved outlook eased concern over how retailers will cope with challenges that range from snarled supply chains and labor shortages to rising costs. Rival Home Depot Inc. surged on Tuesday after reporting similarly strong results.

Lowe’s is looking for ways to limit consumer price increases, Ellison said.

“We think that we have the ability to manage all of the near-term inflationary challenges that we face,” he said. “We’ll continue to find cost offsets so we don’t push unnecessary price increases to the customer. That’s exactly what we did in the third quarter.”

Lowe’s shares rose as much as 1.7 per cent at 9:30 a.m. in New York. The stock advanced 53 per cent this year through the close on Tuesday.

RISING SALES

Same-store sales in the U.S., a key retail metric, increased 2.6 per cent in the third quarter, Lowe’s said in a statement. Analysts surveyed by Bloomberg had anticipated a decline.

Adjusted earnings of US$2.73 a share topped the average analyst estimate of US$2.35. Net sales also exceeded expectations.

While the holiday season isn’t the biggest one for Lowe’s -- that would be springtime, when home owners embark on big improvement projects -- the retailer is increasingly looking to become a gift destination by stocking up on targeted merchandise. Most of Lowe’s customers are shopping early because they’re seeing warnings about possible shortages, Ellison said. That’s leading shoppers to purchase items such as Christmas trees and inflatables yard ornaments earlier than in years past.

“When I look at holiday trends right now, we feel great about what the business looks like early November,” he said. “That continues to point to the fact that the things that we’ve done to get ourselves in a good in-stock position are paying off,” he said.