Nov 20, 2018

Lowe's to shed more assets in new CEO's restructuring

, Bloomberg News

Lowe’s Cos. continued to revamp its operations under new Chief Executive Officer Marvin Ellison, saying it will exit about a dozen stores in Mexico and two small business units. These moves came as it reported a sluggish third quarter and cut its annual forecast.

Same-store sales rose 1.5 per cent, trailing analysts’ estimates of 2.9 per cent. The U.S. units the company is divesting are Alacrity Renovation Services and Iris Smart Home.

Key Insights

- This was the first full quarter under Ellison, who has been aggressive since becoming CEO in July. He’s told investors that he needs time to focus the company on improving core operations, and he’s removing distractions and underperforming assets to do that. The review of the business has been “substantially” completed, Lowe’s said.

- Operations still need work. For the second straight quarter, Ellison said results were hurt by weakness in basic retailing, like keeping items in stock and resetting stores for a new season.

- Lowe’s did manage to meet profit targets, which have been a problem for the company. Earnings of US$1.04 a share topped analysts’ average estimate of 98 cents.

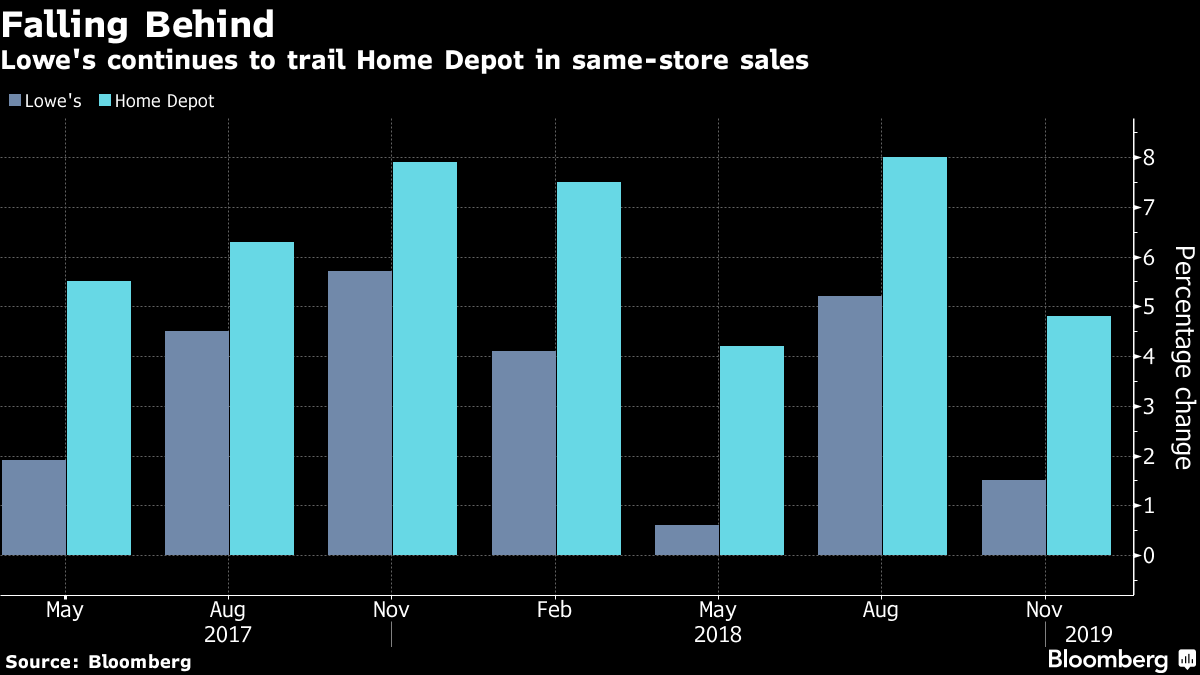

- The investor backlash that led to Ellison’s arrival centered on how the company has so often failed to measure up to Home Depot Inc., its larger rival. These comparisons are set to continue: Home Depot outpaced Lowe’s in same-store sales with an increase of 4.8 per cent.

- The company cut its fiscal-year sales and earnings forecast last quarter, and it did it again Tuesday. Taking into account exiting Mexico and other store closings, Lowe’s now expects sales to rise 4 per cent, not 4.5 per cent, and it also slashed its earnings-per-share expectation.

Market Reaction

- Lowe’s fell as much as 6.8 per cent to US$85.15 in premarket trading Tuesday. The stock has already wiped out most of the gains since Ellison’s hire was announced in May and reached an all-time high of US$116.84 in September. Through Monday’s close, the shares had dropped 1.7 per cent this year.

--With assistance from Karen Lin (Bloomberg Global Data).