Jan 17, 2020

LVMH Wants to Shine Bright Like a Diamond

, Bloomberg News

(Bloomberg Opinion) -- If you have to ask the price, you can’t afford it. No wonder Bernard Arnault, France’s richest man, isn’t disclosing the details of LVMH Moet Hennessy Louis Vuitton SE’s deal to carve up the second-biggest diamond ever recorded in the history books.

On Thursday, Lucara Diamond Corp. said it had entered into a collaboration with LVMH that will see the 1,758-carat Sewelo diamond, which is roughly the size of a tennis ball, turned into Louis Vuitton jewelry. The stone’s name means “rare find.” LVMH is probably one of the few luxury groups that could strike such a deal.

But this is no vanity project. It comes hard on the heels of LVMH’s about $16 billion purchase of Tiffany & Co., the go-to destination for engagement rings wrapped in that iconic little blue box. If that indicated the French company’s intent in jewelry, this leaves no doubt.

It’s not yet clear how exactly the rough diamond will be used. Louis Vuitton has been expanding in fine jewelry, with its Maison Vendome flagship story has a dedicated space for the category with its own entrance on the Place Vendome, the epicenter of Paris jewelry retailing. The group’s other jewelry houses include Bulgari, Fred, Chaumet, and the soon-to-be-added Tiffany. Christian Dior, meanwhile has the potential to sell lots of pricey adornments to its fashionista fans.

However it eventually polishes up, the Sewelo will be part of the classic luxury playbook.

LVMH will likely create several extremely high-end pieces to establish a sense of exclusivity. While only a small number of customers may be wealthy enough to purchase these, many more will be able snap up Tiffany bangles or Louis Vuitton rings. LVMH is counting on the hard-to-fathom stone to encourage these purchases, too. It’s the diamond-encrusted equivalent of sending extravagant creations down the catwalk in order to sell trunk loads of Louis Vuitton’s popular Neverfull bags, which sell for about 1,000 pounds ($1,307).

Even taking this strategy into account, it’s likely that LVMH will seek to take Tiffany upmarket. There’s scope to increase its margins by jettisoning lower-price products and selling more high-end pieces. The allure of the Sewelo will help in this process, too.

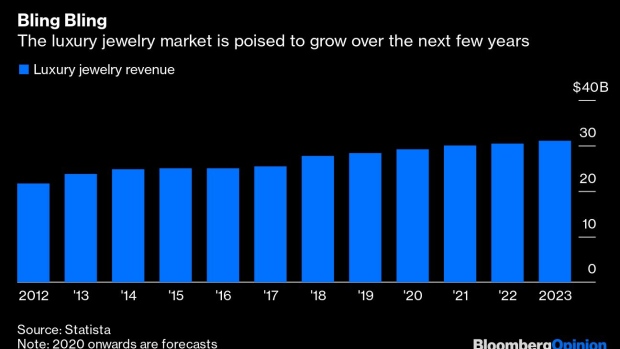

The luxury jewelry market is growing strongly, with particular demand for items boasting a designer label. Bain & Co. estimates that excluding currency fluctuations, sales rose 9% in 2019, in contrast to watches, where sales fell 2%. Timepieces have been hurt not only by the unrest in Hong Kong but by the segment’s continued disruption by smart and connected watches. Jewelry faces no such technological shifts. So there’s plenty of room for LVMH to expand.

A more muscular rival is a worry for companies including Richemont, which owns Van Cleef & Arpels and Cartier, as well as Swatch Group AG, which owns Harry Winston. It could also make it harder for LVMH’s French archrival Kering SA, which also has scope to sell more jewels, to do so. Luca Solca, analyst at Bernstein, has suggested that a merger between Richemont and Kering would be a formidable response.

LVMH’s Sewelo gem gambit is not without some potential pitfalls. At the moment it is a rough stone, whose outer surface is still covered in a layer of carbon. It’s not yet clear what kind or quality of polished gem it will reveal. Lucara Diamond previously said it may not deliver the highest standard.

Whatever emerges, the stone’s size alone will make for an interesting story for LVMH’s marketing team. And with the group being at the cutting edge of fashion, it may be bolder and more creative than a diamond dealer, whose primary concern is usually how many carats can be secured in order to maximize the sale price. Add in the halo effect around the jewelry maisons — the Sewelo will be shown to clients and press at the Paris couture shows next week before embarking on a world tour — and there’s even less of a risk.

So even if the Sewelo doesn’t turn out to be as much of a sparkler as hoped, it will still help LVMH sell plenty of other baubles.

To contact the author of this story: Andrea Felsted at afelsted@bloomberg.net

To contact the editor responsible for this story: Melissa Pozsgay at mpozsgay@bloomberg.net

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

©2020 Bloomberg L.P.