May 8, 2019

Lyft plunges to low as loss overshadows revenue growth

, Bloomberg News

Expect Netflix-style 'subscription-like elements' for Lyft in future: Analyst

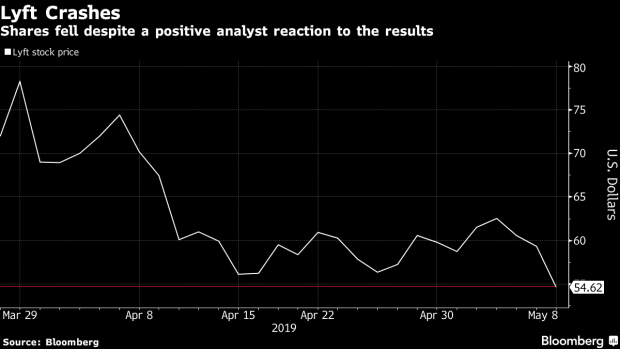

Lyft Inc. shares tumbled to a record low on Wednesday after the newly public ride-sharing company reported a steep quarterly loss that was seen as offsetting better-than-expected revenue growth.

Shares fell 11 per cent to US$52.91 in New York, its lowest price since becoming a public company in March. The slide, its third decline in as many days, trimmed its market value to US$15.25 billion, near the US$15.1 billion private value prior to its offering. The stock has lost 27 per cent since its debut. The rout comes as its larger competitor, Uber Technologies Inc., plans to price its IPO Thursday night.

Analysts were broadly positive on the results, though Stifel conceded that the quarterly loss “will likely be difficult for some investors to look past,” and Piper Jaffray wrote that the stock “may not be the right fit for all investors” given its “materially unprofitable state.”

Nevertheless, at least three firms raised their price targets, viewing the growth in revenue and active riders as positive signs for Lyft’s long-term prospects. They also pointed to an agreement with Waymo as a potential tailwind.

Here’s what analysts are saying about the results:

Piper Jaffray, Michael Olson

The stock “may not be the right fit for all investors, given the company’s current materially unprofitable state, but for those with a long-term view, and patience, we recommend owning shares at these levels.”

Expects company to be a long-term beneficiary of ride-sharing and “autonomous tech.”

Overweight rating, US$78 price target.

KeyBanc Capital Markets, Andy Hargreaves

“Lyft is performing well and retains a strong top-line growth outlook. However, the ride-sharing market appears to be slowing and the degree of long-term profitability remains uncertain.”

Sector weight rating.

Jefferies, Brent Thill

The company showed both “strong momentum” in revenue and other metrics, and “significant progress in reducing losses.”

The valuation is “attractive,” and Jefferies expects the stock to recover as “misconceptions clear.”

Buy rating, price target raised to US$90 from US$86.

Cowen, John Blackledge

Lyft is well positioned to scale “as secular tailwinds drive rising user penetration & frequency.”

Outperform rating. Price target raised by US$1 to US$78.

Stifel, Scott W. Devitt

The quarter was a “positive as the company progresses towards its long-term goals,” and its active rider growth “has the potential to outperform expectations over the medium to long term.”

While the company’s “deep losses will likely be difficult for some investors to look past,” growth in riders and revenue “will be the near- to mid- term proxy of Lyft’s success as a business.”

Buy rating, price target raised to US$70 from US$68.

Canaccord Genuity, Michael Graham

The competitive landscape is becoming “increasingly rational,” which should ease concerns about pricing.

Lyft has all the “hallmarks of an attractive growth equity investment,” including a large addressable market, a value that should only get better as it scales, and a business model “that holds solid room for upside.”

Keeps buy rating and US$75 target.

What Bloomberg Intelligence Says

A partnership with Waymo “puts the company in a better position to take advantage of its scale and network effects and build out services in autonomous vehicles, scooters and perhaps food delivery.” However, competition and other factors could limit Lyft’s Ebitda margin in the near term.

-- Mandeep Singh, technology analyst.