May 5, 2022

Macquarie Profit Tops Estimates On M&A Wave, Market Swings

, Bloomberg News

(Bloomberg) --

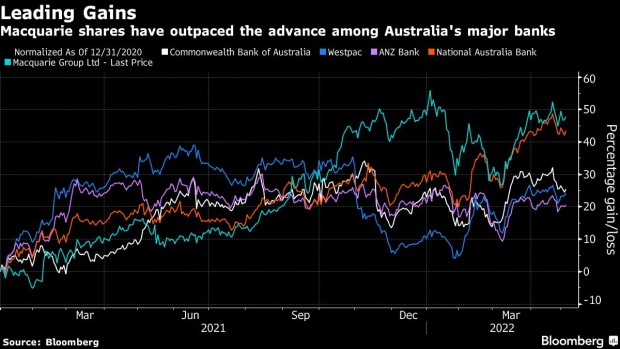

Macquarie Group Ltd.’s profit topped analyst estimates and hit a record as commodities trading surged and Australia’s dealmaking boom endured.

Net income for the year to March 31 rose to A$4.71 billion ($3.35 billion), compared with A$3 billion a year earlier, the company said in a statement Friday. That beat the A$4.22 billion estimate of seven analysts surveyed by Bloomberg.

Three of the Sydney-based investment bank and asset manager’s four operating groups had their best-ever performance. Profits from investment banking and commodities trading were up 92% on the prior year, while its banking and asset management units climbed 25% over the period.

“We continue to maintain a cautious stance, with a conservative approach to capital, funding and liquidity that positions us well to respond to the current environment,” Chief Executive Officer Shemara Wikramanayake said in the statement.

Meantime, the firm will pay a final dividend of A$3.50 per share, while assets under management grew 37% to A$774.8 billion.

CEO Wikramanayake took home A$25.8 million, while Nick O’Kane, the head of commodities and global markets, received A$36.2 million.

What Bloomberg Intelligence Says

“Macquarie’s record fiscal 2022 profit of A$4.7 billion, up 56% vs. 2021, may be tough to beat next year. Volatility due to the war in Ukraine, big jumps in bond yields and booming commodity prices seem unlikely to perist” -- Senior industry analyst Matt Ingram. Read the report here.

(Adds executive pay details and Bloomberg Intelligence comments from sixth paragraph)

©2022 Bloomberg L.P.