Jun 1, 2023

Macron’s Plan to Cut French Debt Burden Is Running Aground

, Bloomberg News

(Bloomberg) -- Emmanuel Macron’s economic transformation of France is starting to show cracks as the country’s massive debt burden casts a shadow over his plans.

The president’s reliance on growth-enhancing reforms to curb borrowing and his frequent recourse to crisis spending are meeting increasing skepticism from ratings firms questioning his government’s capacity to repair its public finances.

Fitch downgraded France in April, while Scope Ratings put a negative outlook on its assessment last week. Ministers are bracing for another decision from Standard & Poor’s this Friday.

Investors are showing some signs of caution too, with the premium that French bond yields offer over Germany widening by 15 basis points since January. The equivalent metric for Italy, which has much higher borrowing costs, has remained stable over the same period.

“We and the rating agencies have been highlighting the weakness in France’s public finances for some time,” said Adam Kurpiel, rates strategist at Societe Generale SA. The risk of a downgrade Friday “could be a wakeup call for the markets.”

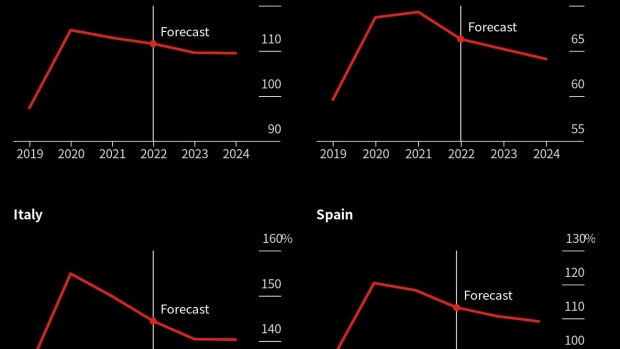

France finds itself in an awkward club along with Italy and Spain, all of whose efforts to curb borrowing built up during more than a decade of crises are stalling. Debts in those three economies — Europe’s largest after Germany — have soared well above 100% of output and will barely shrink in the coming year, according to European Union forecasts.

To be sure, France is well clear of junk levels, and downgrades of highly-rated countries have little effect on investor behavior. Moody’s Investors Service kept its own assessment intact in April when a scheduled announcement didn’t materialize.

But a gradual shift in sentiment risks undermining the view Macron has projected as the catalyst for the reversal in the country’s long-term economic fortunes.

“A revision of a rating is not a big deal, but it really shows that the economic outlook is darkening and that the public finance situation is not bright,” ING’s France economist Charlotte de Montpellier said. “The risks that existed before are a bit more visible right now.”

Since taking office in 2017, Macron’s fiscal approach has aimed to avoid austerity or levies on households to bring down debt, instead relying on overhauls of the labor market and changes to corporate taxation to drive employment and growth.

Things started well for the investment banker-turned-president as the budget deficit fell below 3% of economic output in 2018 for the first time since the global financial crisis. Labor reforms continue to pay dividends with unemployment now at a 40-year low.

With the exception of DBRS Morningstar stripping France of its top rating during the pandemic, the country sailed through without downgrades until Fitch this year.

Yet when Macron faces a crisis, he tends to spend. Tax breaks and other measures to respond to the Yellow Vest protests beginning in 2018 totaled around €17 billion ($18.2 billion), and when Covid struck Macron embraced a “whatever-the-cost” approach to public spending amounting to around 10% of economic output.

His government’s Covid recovery plan delivered €100 billion in extra outlays, and the finance ministry reckons that measures to mitigate surging energy prices will reach around €40 billion and only be fully phased out over the next two years.

France’s central bank has cautioned that the government must now find a path to stabilize public spending and stop introducing tax cuts that are not financed.

“I’m not calling for austerity and a generalized decline in spending, but we can’t have the highest public spending of all developed nations that is also much higher than our European neighbors, and continue to increase it,” Bank of France Governor Francois Villeroy de Galhau said at a conference at the Toulouse School of Economics on Thursday.

Net debt supply is on track for an annual record, according to Natixis strategists including Theophile Legrand. Their forecast factors in efforts by the European Central Bank to shrink its crisis-era bond portfolio.

Throw another potential ratings downgrade into the mix and a significant reduction in France’s yield premium over Germany looks “much harder” to achieve, they added. The spread has roughly tripled from a low of just 20 basis points in early 2021.

For investors, a downgrade “would not alter their fundamental perception of French debt, which remains one of the most liquid in the world,” they wrote. However, some could reduce their exposure to it, “notably non-residents which hold around half of France’s debt.”

The government has sought a change of tack. Finance Minister Bruno Le Maire set a target for a narrower deficit in April and advanced negotiations over next year’s budget to seek cost savings. Last week, he instructed ministries to set aside an extra 1% of their allotted credits this year in an effort contain spending.

But ratings firms aren’t convinced that ambitious objectives are sufficient, in part as France has struggled to keep such promises in the past.

Macron is also continuing to pledge more investment in the climate transition, defense and a reboot of ailing industry, even while officials forecast the annual cost of servicing France’s debt to increase more than 50% to €70 billion by 2027.

“Fiscal consolidation in the years preceding the pandemic was weak, despite a period of stronger growth,” Fitch said last month.

Ratings companies say Macron’s approach may now be endangered by politics after violent protests over pension reform. His failure to build alliances over raising the retirement age has crystallized opposition in parliament and among labor unions.

Standard & Poor’s has warned it might downgrade France if there is no decline in debt in the next two years. Factors it says could affect the budget include a lack of structural reforms, high interest payments on debt, and a prolonged economic slowdown.

“There are very close discussions,” with the ratings company, French Prime Minister Elisabeth Borne said on Radio J Sunday. “Le Maire has given detailed explanations of everything we are doing to control our public finances.”

(Adds comments from Bank of France governor in 16th paragraph)

©2023 Bloomberg L.P.