Mar 1, 2022

Malaysia Has Enough Cooking Oil Supplies to Blunt Record Prices

, Bloomberg News

(Bloomberg) -- Malaysia has adequate supplies of government-subsidized cooking oil to meet local demand and help blunt the impact of food inflation on lower income groups, according to Plantation Industries and Commodities Minister Zuraida Kamaruddin.

“The rising costs in Malaysia and elsewhere is something we have expected, given the effect of the pandemic where price rises ripple through economies worldwide,” Zuraida said in reply to emailed questions.

The war in Ukraine and sweeping sanctions on Russia have bolstered edible oil prices, which were already climbing after drought and labor shortages squeezed supplies. The rally is putting strain on Malaysia, where food inflation in January accelerated at the fastest pace in four years.

“There is a concern about the inflation and its impact on consumers, especially for those under B40,” she said, referring to the poorest 40% of the population. Still, the supply of subsidized cooking oil is sufficient to meet the needs of the low-income and 75% of the middle-income groups, Zuraida said.

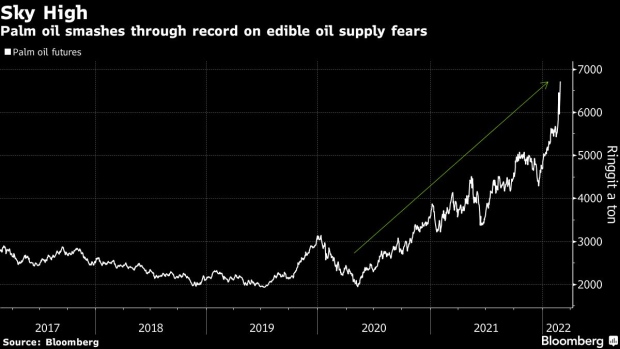

Palm oil, used in a plethora of consumer goods from cooking oil to instant noodles, has smashed through records. Benchmark futures in Kuala Lumpur hit 6,794 ringgit ($1,620) a ton on Tuesday, extending a rally that’s seen prices double since mid-June.

Palm oil’s supply woes began in early 2020 after Malaysia shut its borders and froze hiring of migrant workers to stem the surge in Covid-19 cases, resulting in a historic labor shortage across plantations in the second-biggest grower. The decision in January by top grower Indonesia to curb shipments to expand local supply tightened the market further.

Zuraida said that the ministry is planning a “comprehensive review” of federal, states and local taxes that increase planters’ operating costs and affect Malaysia’s competitiveness versus Indonesia.

The study, planned to begin in mid-2022, “will result in a more efficient taxation scheme that not only contributes to economic development but enhances the competitiveness” of the Malaysian palm oil industry, she said.

The review does not include the country’s export duty structure, which will be maintained between 3% and 8% based on the level of crude palm oil prices.

©2022 Bloomberg L.P.