Aug 12, 2022

Malaysia’s Economy Expands 8.9% in the Second Quarter, Fastest Pace in a Year

, Bloomberg News

(Bloomberg) -- Malaysia’s economy grew at the fastest clip in a year, fueled by a surge in consumption underpinning the recovery of services and manufacturing, boosting the central bank’s scope to focus on fighting inflation.

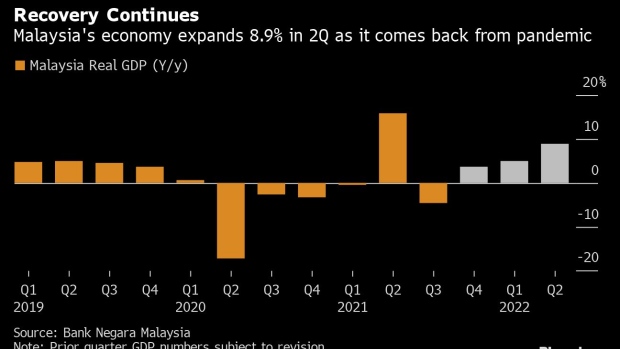

Gross domestic product expanded 8.9% in the April-June period from a year ago, according to Bank Negara Malaysia, beating the 7% median estimate in a Bloomberg survey. Output rose 3.5% from the first quarter against a median estimate of a 1% growth.

The resource-rich economy is gaining traction on pent-up demand from the easing of mobility restrictions, rising employment and firmer prices for the country’s commodity exports. The government now expects full-year GDP growth at the upper end of its 5.3%-6.3% forecast, central bank Governor Nor Shamsiah Mohd Yunus said at a briefing in Kuala Lumpur on Friday.

At the same time, headline inflation will probably average closer to the top end of a 2.2%-3.2% range, the governor said, adding that monetary policy continues to be accommodative after raising the policy rate by a total of 50 basis points since May.

The GDP number is “undoubtedly a blow-out figure that speaks to the strength of the recovery in domestic consumption post pandemic, and bolstered by the continued exports strength,” said Wellian Wiranto, an economist at Oversea-Chinese Banking Corp. in Singapore. “An all-around encouraging print that should bode well for the momentum going into second half even if the global outlook looks less favorable.”

Growth momentum is expected to remain strong in the third quarter ending September, driven by robust foreign trade and tourism, Finance Minister Zafrul Aziz said in a statement Friday evening. Even so, the government remains cautious for the second half of 2022 due to the uncertainty sparked by the Russia-Ukraine conflict and stumbling growth in China, he said.

Measured, Gradual

Rising price pressures from the reopening may support another quarter-point rate hike in September, analysts including Winson Phoon from Maybank Securities Pte, said before the GDP report.

“BNM can keep hiking given its goal to reduce policy accommodation as the recovery takes holds,” said Euben Paracuelles, chief Asean economist at Nomura Holdings Inc. in Singapore. “We continue to forecast 25-basis point hikes in each of the remaining two meetings of this year, taking the policy rate to 2.75%.”

Any adjustments to monetary policy would be done in a “measured and gradual manner to support a sustainable economic growth,” Shamsiah said. Rate adjustments would also “pre-emptively manage the risk of excessive demand on price pressures,” she said.

Private consumption jumped 18.3% in the second quarter from a year ago, compared to the 5.5% growth in January-March while both private and government investment rose. The services sector expanded 12%, accelerating from 6.5% growth in the first quarter while manufacturing growth quickened to 9.2% from 6.6%.

Ringgit was flat at 4.4450 versus the dollar at 4:45 p.m. local time, while the main equities index was set for its fourth week of gains.

“We have enough tailwinds in the domestic consumption and investment and these will offset the moderation in growth in the second half of the year,” Shamsiah said. “We are sticking to our growth forecast,” she said.

(Updates with Finance Minister’s comment in sixth paragraph)

©2022 Bloomberg L.P.