Feb 26, 2021

Malaysian Bank That Highlighted 1MDB Scandal to Pay $699 Million

, Bloomberg News

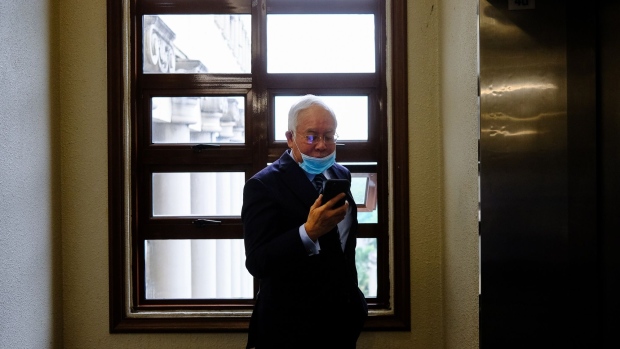

(Bloomberg) -- The Malaysian lender that held former Prime Minister Najib Razak’s bank accounts, which put a spotlight on the country’s 1MDB scandal, has agreed on a settlement with the government.

AMMB Holdings Bhd. will pay 2.83 billion ringgit ($699 million) in a settlement over its involvement in transactions related to state investment company 1MDB.

The payment is for “all outstanding claims and actions in relation to the AmBank Group’s involvement in the 1MDB matter,” Malaysia’s finance ministry said in a statement on Friday, referring to a unit of AMMB. The statement didn’t specify AMMB’s wrongdoing in the 1MDB scandal that it was penalized for.

There were allegedly accounts bearing former Najib’s name at AmBank where billions of ringgit passed through, with global investigators believing that the monies originated from 1MDB. Najib had acknowledged receiving $681 million as a “personal contribution” from the Saudi Arabian royal family, and he later said he returned $620 million.

The lender had also previously arranged a bond sale related to 1MDB, in which investigators probed if funds had been misappropriated.

The settlement will have a “material impact” on AMMB’s earnings for the year ending March 2021, the compay said in a stock exchange filing on Friday.

The 1MDB scandal set off investigations in Asia, the U.S. and Europe, and led to the ouster of Najib in 2018. Authorities spent years tracking funds that allegedly flowed from 1MDB into ornaments of wealth. Goldman Sachs Group Inc. last year admitted its role in the biggest foreign bribery case in U.S. enforcement history, reaching multiple international settlements in the billions of dollars to end probes into its fundraising for 1MDB.

The AMMB settlement is in addition to a 53.7 million ringgit penalty that the Malaysian central bank imposed on AmBank in 2015 for what was described as non-compliance with certain regulations, with no details given then. AmBank has taken measures to address lapses associated with these transactions, the finance ministry said Friday.

As part of the agreement, Malaysia’s Securities Commission will require AMMB unit AmInvestment Bank Bhd. to take corrective measures, including establishing systems and processes to strengthen the due-diligence framework for the submission of corporate proposals, the finance ministry said.

“Resolving this through the court system would have cost a lot of time, money and resources,” Finance Minister Zafrul Abdul Aziz said in the statement. “With this settlement, the payment of the monies will be expedited, instead of being held up by lengthy court battles, and can be utilized to fulfill 1MDB’s outstanding obligations.”

©2021 Bloomberg L.P.