Sep 10, 2020

Mall operators should bet on Amazon, not J.C. Penney

, Bloomberg News

J.C. Penney landlords sign deal to keep stores open

(Bloomberg Opinion) -- J.C. Penney Co. has a fresh shot at returning itself to retailing relevance. The department store chain said Wednesday evening it had reached an agreement to be rescued from bankruptcy by mall operators Simon Property Group and Brookfield Property Group in a deal valued at US$1.75 billion. But is this the best outcome?

There are upsides to sparing this mall stalwart from liquidation. The acquisition has preserved tens of thousands of jobs and staved off more disruption at U.S. shopping centers, which are reeling from widespread store closures and pandemic-related shopper caution. Still, the deal could turn out to be short-sighted for the mall operators, a squandered moment to reimagine their spaces for the future instead of just trying to survive.

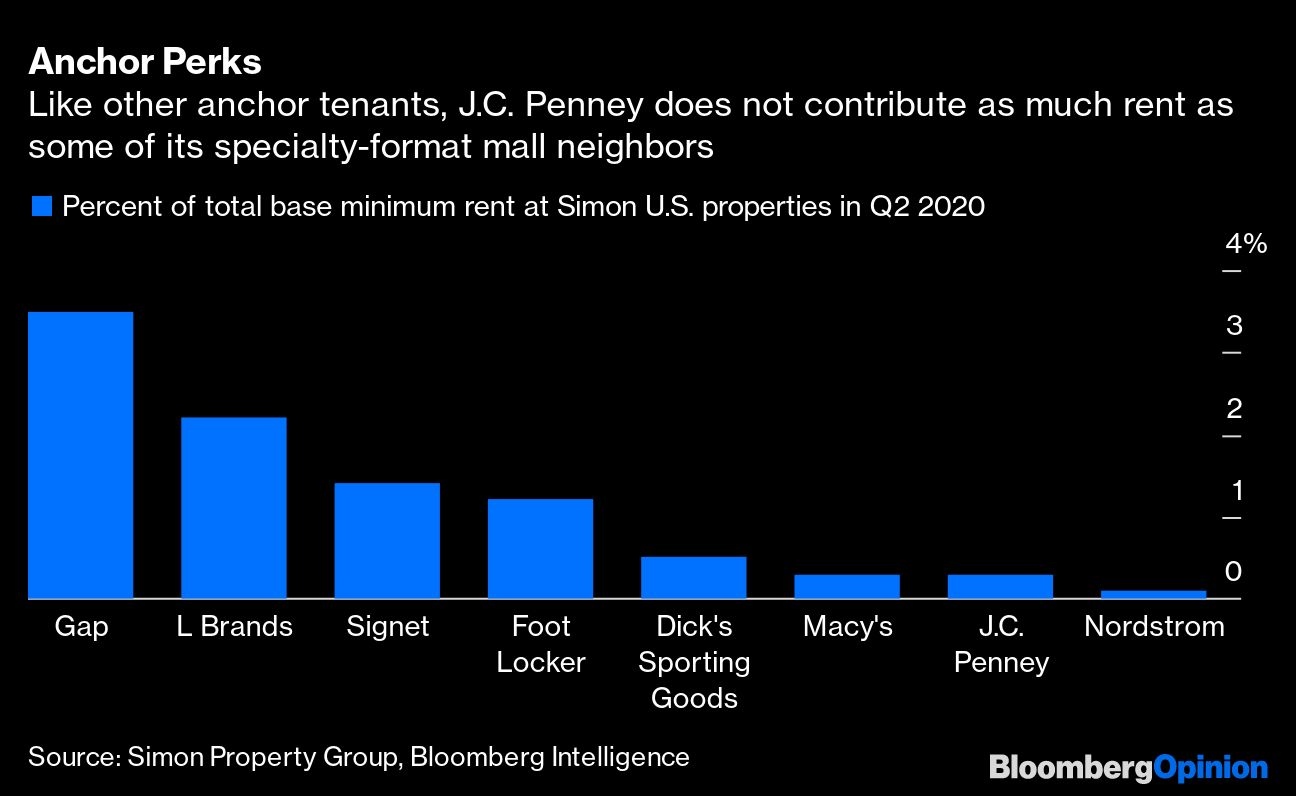

It is understandable that Simon and Brookfield wouldn’t want to see J.C. Penney go out of business right now. Even though anchor tenants such as J.C. Penney don’t typically pay top-dollar rents, no one wants that much vacant square footage in their malls. Empty store fronts don’t exactly make the place look exciting and inviting. And shopping centers are an ecosystem, with each store helping draw traffic to the others.

There would be clearer logic to saving the chain, though, if it hadn’t been so troubled before the pandemic. J.C. Penney had frequently recorded annual losses in recent years, including under Ron Johnson’s brief but disastrous tenure as CEO, when it alienated customers by pivoting away from its familiar promotion and discounting strategy. Later, another CEO, Marvin Ellison, tried to position J.C. Penney as a destination for appliances in a bid to steal business away from struggling Sears, an approach that didn’t meaningfully reinvigorate the chain – and was quickly abandoned by his successor.

More recently, CEO Jill Soltau has been working to revamp the in-store shopping experience with nicer dressing rooms and less clutter. And then came the pandemic, which has left many consumers avoiding in-store shopping and reduced their need for work clothes and dressy attire.

So, in rescuing J.C. Penney, the mall operators have preserved some semblance of near-term stability and normalcy at their centers. Unfortunately, that allows them to kick the can down the road on a harder, but ultimately more important, task: dramatically transforming their brick-and-mortar outposts into places that can thrive long after the pandemic has receded. Having to hunt for a tenant for those cavernous J.C. Penney stores right now would be extremely difficult, but it would also force more creativity. For example, the Wall Street Journal reported last month that Simon was in talks with Amazon.com Inc. about the online shopping behemoth setting up fulfillment centers in spaces once occupied by Sears or J.C. Penney, an unconventional set-up that is absolutely worth trying. Maybe letting J.C. Penney fail would encourage more such innovative approaches.

In general, it’s good that Simon and Brookfield are committed to helping key business partners weather the once-in-a-generation storm that is roiling the retail world. But, in the rear-view mirror, this particular salvage attempt may end up looking like a missed opportunity.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.