Dec 6, 2021

Marathon Digital, Riot Lead Crypto Stocks Lower as Bitcoin Sinks

, Bloomberg News

(Bloomberg) --

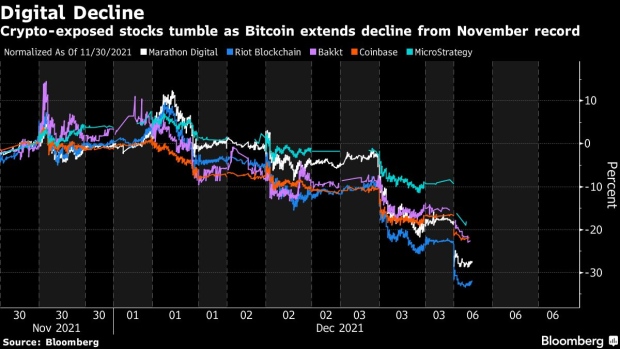

Stocks exposed to cryptocurrencies plunged in premarket trading on Monday as Bitcoin’s retreat from the record high it reached last month ballooned to nearly 30%.

Marathon Digital Holdings Inc., Riot Blockchain Inc., and MicroStrategy Inc. all saw their shares sink by at least 8%, adding to last week’s sharp losses amid a broader shift away from risk assets by investors. Other stocks with heavy exposure to the crypto space also fell, with Coinbase Global Inc. and Bakkt Holdings Inc. down 4% and 9% respectively.

READ: Bitcoin’s Outsized Drop Versus Ether May Stem From Macro Link

“Crypto coins and tokens have been propelled higher in this era of ultra cheap money and as speculation swirls about just when central banks will start further tightening mass bond buying programs and start raising interest rates, they are likely to continue to be highly volatile,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

Bitcoin’s latest selloff hit a fever pitch on Saturday, as the world’s largest digital token dropped as much as 21% before paring its losses to just over 9%. The volatile trading spread to other digital tokens including Ether and Litecoin, both of which saw declines this morning. Meanwhile the recently launched ProShares Bitcoin Strategy exchange-traded fund, fell 9% in premarket trading, putting it on track for a fresh record low.

Monday’s slump by crypto-linked stocks adds to what was a painful four-day stretch last week as global markets experienced a broader shift away from riskier asset classes. The Amplify Transformational Data Sharing ETF, which holds a range of shares linked to the cryptocurrency space, tumbled by nearly 9%, its biggest weekly loss since July.

©2021 Bloomberg L.P.