Mar 10, 2020

'Market paralysis' grips Canada traders waiting for shoe to drop

, Bloomberg News

Markets rise after the Monday meltdown

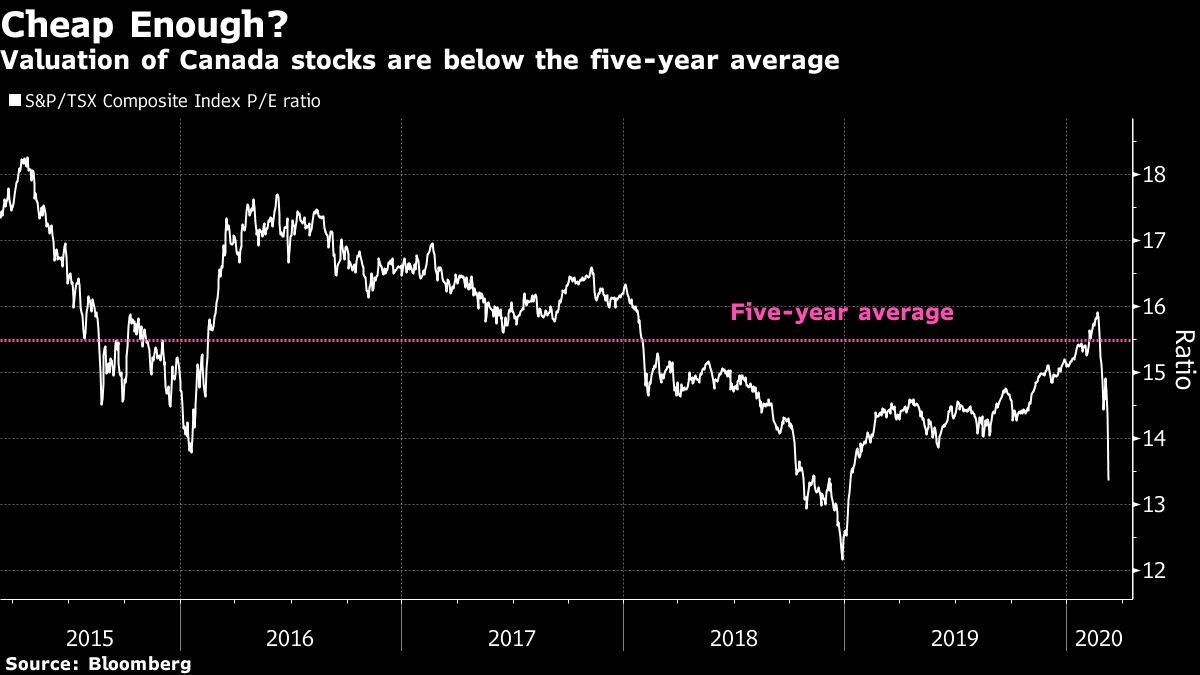

Canadian stocks have posted their biggest drop since Black Monday in 1987, the loonie has weakened and bond yields have plummeted to fresh lows. Time to buy?

Not quite yet. Investors are staying on the sidelines even though Monday’s crash has pushed valuations for the country’s equity benchmark below the five-year average.

For many investors, days like this trigger a “market paralysis” as everyone tries to figure out what’s next, said Hugo Ste-Marie, analyst at Bank of Nova Scotia. Energy stocks are getting pounded and a lack of visibility on the coronavirus crisis could remain challenging, he said.

The S&P/TSX Composite Index tumbled 10.3 per cent on Monday, the biggest one-day percentage drop since Oct. 19, 1987. It has now fallen 19.1% since Feb. 20 -- pushing it to the cusp of the bear market marker of 20 per cent.

The loonie reversed some of its slump against the U.S. dollar and government bond yields are creeping closer to negative rates. Investors are growing more pessimistic about an economy that barely eked out any growth in the fourth quarter and is grappling with the coronavirus.

Gentle Buying

While valuations have dropped, Steve Digregorio, portfolio manager at Canoe Financial, is staying on the sidelines for now. He has 15% of his portfolio in cash.

“We are sitting on a pretty healthy cash balance. It is too hard right now to predict where earnings are going to go so we are waiting,” he said. “Ultimately at some point you are going to have to buy equities and buy it very aggressively.”

Michael Archibald, portfolio manager at AGF Investments Inc., is buying the dip cautiously, reducing his cash position slightly from 8% on Friday.

“We have been gently adding into positions that we already had. We’ve been adding new positions on names we haven’t owned in the past,” he said. “I have deployed a small amount of that today. I suspect that if we continue to get this kind of volatility we’ll likely continue to keep deploying over the coming weeks.”

Rescue

With liquidity beginning to dry up in some markets, some investment managers are waiting for central bank action.

“I suspect that you’re going to start getting news about significantly more liquidity injection in the market to calm market participants,” Archibald said. “That will likely be the first stage at which the market will start to put in a short-term low and we should probably start to see a little bit of upward movement in prices.”

The stimulative impact of lower oil prices for consumers could help with boosting the economy and in turn, markets, said Candice Bangsund, portfolio manager at Fiera Capital. “Recent disorderly moves in financial markets have reinforced the case for aggressive fiscal support in conjunction with easier monetary policy – which should help to boost confidence, stock prices, and bond yields,” she said.

Radio Silence

While traders and strategists have been glued to their screens, clients haven’t been calling them in a panic, some asset managers said.

“We have not had one client phone call,” David Baskin, president and founder of Baskin Financial Services Inc., said by phone. “My investors seem to be taking this with equanimity.” Baskin’s Toronto-based fund has US$1.3 billion in assets under management and a zero weighting in energy.

AGF’s Archibald also hadn’t received any specific calls from rattled investors. But he said that anxiety is clearly prevalent, given the plunge.