Dec 8, 2021

Market Swings Scuttle the Finale of a Record Year for IPOs

, Bloomberg News

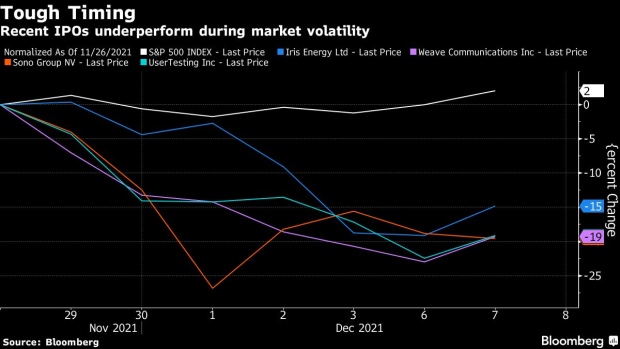

(Bloomberg) -- Recent volatility is spoiling hopes for a meaningful wave of U.S. initial public offerings to close out a record year for listings worldwide.

Fifteen of the last 20 U.S. IPOs ended Tuesday’s session below their offering price with traders risk averse after more than a week of stock market volatility. Despite this week’s nascent rebound, some investors are expecting more market swings ahead, upending the hospitable conditions that paved the way for 2021’s record IPO stretch.

“Recent equity market volatility bears watching after equity-price strength and generally muted volatility has supported issuance levels so far this year,” Bloomberg Intelligence analyst Alison Williams wrote in a note.

U.S. futures climbed on Wednesday during premarket trading, positioning stocks for their third straight session of gains after a week of price swings. The market’s comeback this week is keeping hopes alive for a higher pace of dealmaking, but the Cboe Volatility Index, a measure of market fear watched closely by IPO bankers, above 20 is still signaling subpar conditions to go public.

Just five traditional IPOs are on the calendar for this week, according to data compiled by Bloomberg. Excluding holidays and the traditional August vacation season, this will be the slowest week for IPOs since May.

It would have been an even slower period if not for Brazil’s Nu Holdings, which had to schedule its debut more than a month ago, unusually early due to a quirk of its dual listing in both the U.S. and Brazil. The longer book building process exposed the deal to big swings in the market, and Nu slashed its price range after volatility picked up.

Traditional IPOs aren’t the only new listings feeling the pain. Risk-off trading also stung a pair of high-profile mergers with special purpose acquisition companies. Both BuzzFeed Inc. and Grab Holdings Ltd. have traded down since going public.

©2021 Bloomberg L.P.