Sep 23, 2021

Market Turmoil Greets China’s Southbound Bond Connect

, Bloomberg News

(Bloomberg) -- A new channel for Chinese investors to purchase debt overseas is launching at a tumultuous time for the nation’s offshore market.

The southbound link of the Bond Connect opens Friday, drawing capital from the mainland to the southern city of Hong Kong to complete the loop with a northbound program started in 2017. With 41 banks among those eligible to participate during the initial phase, analysts see it eventually boosting China’s offshore bond market and issuance of Dim Sum and ESG-compliant notes, as well as bringing offshore and onshore yields closer.

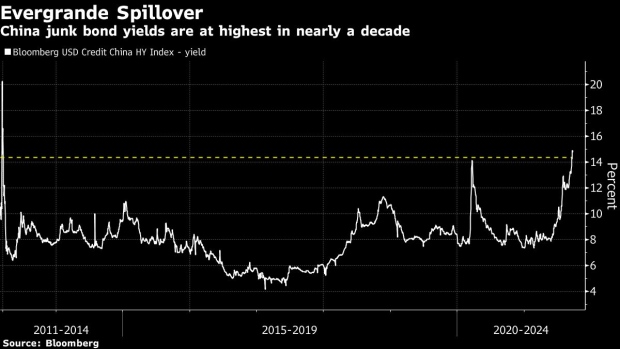

The launch, announced last week by the People’s Bank of China and the Hong Kong Monetary Authority, coincides with markets being roiled by concerns over China Evergrande Group’s liquidity crisis and the financial health of other developers grappling with tougher rules on leverage. China junk bond yields are at their highest in nearly a decade, according to a Bloomberg index.

Traders have sought clarity on how Evergrande, the world’s most-indebted developer, can navigate its way through upcoming obligations -- and what role, if any, Beijing would assume in helping manage fallout from any potential default.

Part of China’s push to modernize its financial markets and allow for more cross-border fund flows, the southbound connect will “gradually become the major channel for domestic financial institutions to trade offshore bonds,” said Ming Ming, head of fixed income research at Citic Securities Co. He added that “short-term sentiment will be negatively impacted by recent credit risk concerns.”

China has long sought a “two-way opening” of its financial system even while maintaining capital controls in efforts to stem potential risks domestically. Before Friday’s southbound launch, the link only allowed flows in the northbound program, providing global access to China’s vast interbank debt market.

“The long-awaited southbound Bond Connect shows China is now less worried on capital outflows,” said Gary Ng, senior economist at Natixis.

The program has an annual quota of 500 billion yuan ($77.3 billion) and a daily quota of 20 billion yuan, both of which can be adjusted based on cross-border fund flows. Hong Kong-issued yuan bonds -- also known as Dim Sum bonds -- as well as dollar and Hong Kong dollar-denominated notes will be available through the channel.

Expectations are that investors will be initially risk-averse. Given “the recent turmoil of the Chinese dollar bond market as well as the intensifying property bond risks, we don’t expect investors to buy risky notes,” said Zhou Hao, senior emerging markets economist with Commerzbank AG. “They may start by trading relatively safe assets.”

The southbound link will compete with other channels already open to the investors it targets, such as the Qualified Domestic Institutional Investor (QDII) and RMB Qualified Domestic Institutional Investor (RQDII) programs. “While it offers another path for cross-border investment, the initial attractiveness may still depend on whether the investment costs are lower than other options,” said Natixis’ Ng.

The latest steps give policy makers the scope to use increased fund outflows to help keep the country’s currency strength in check. Mainland investors have been able to buy Hong Kong-listed shares through Stock Connect programs in Shanghai since 2014 and Shenzhen since 2016. Authorities have also announced a Wealth Management Connect program to allow investments for private wealth between Hong Kong and mega cities in China’s south.

NOTE: Bloomberg LP, the parent company of Bloomberg News, provides Bond Connect services.

©2021 Bloomberg L.P.