Nov 28, 2021

Markets Face Weeks of Uncertainty in Wait for Omicron Answers

, Bloomberg News

(Bloomberg) -- The fate of global markets now depends at least in part on laboratories around the world probing the omicron Covid-19 strain, potentially leaving investors with weeks of uncertainty in the wait for answers.

The variant detected in Africa is described as highly concerning, and has already led to international travel bans. Scientists are analyzing whether it can evade vaccines and how its symptoms differ from current strains. Vaccine maker BioNTech SE expects the first data within two weeks, initial findings that will help to determine if a passing scare or bigger hit to global economic reopening looms.

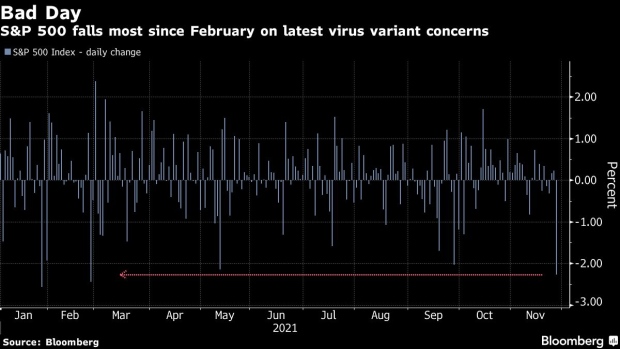

Fearful investors fled stocks worldwide Friday and flocked to havens such as sovereign bonds as volatility spiked. The window for more clarity on omicron to emerge may be two to eight weeks, during which demand for riskier assets could take a hit, according to Citigroup Inc. strategists including Jamie Fahy and Yasmin Younes.

“At a minimum, volatility will be higher the next two weeks,” said Peter Berezin, chief global strategist at BCA Research Inc. Stocks could drop further but a slide of more than 10% is a buying opportunity, he added.

Global shares slid to the lowest since mid-October on Friday, oil lost 13% and the 10-year U.S. Treasury yield fell the most since the early months of the pandemic. Speculative assets like Bitcoin retreated, leaving the world’s largest cryptocurrency some 20% off a Nov. 10 record.

Traders also cut back bets on tighter monetary policy to fight inflation -- which had been the dominant theme amid expectations that the worst of the pandemic was over. Just what omicron means for growth and inflation, however, remains foggy.

“Inflation may have a brief respite by lower energy prices, but lockdowns add to supply constraints while U.S. consumer demand is unabated,” said Ben Emons, global macro strategist with Medley Global Advisors LLC.

Amid the uncertainty, investors sitting on solid year-to-date gains as Christmas nears -- 22% for the S&P 500 -- may be tempted to bank some profits. Another possibility is a preference for the work- and stay-at-home trade until more data surfaces, said Ryan Jacob of Jacob Asset Management.

Major portfolio changes likely aren’t necessary assuming existing vaccines remain effective and that omicron isn’t more malicious than other strains, Goldman Sachs Group Inc. wrote in a note.

But short-term portfolio hedges may be appropriate “given the time of the year and liquidity as well as policy risks in December,” according to the note, which gave call options on 10-year Treasury futures as among the hedges to consider.

Past virus scares ended up being a chance to load up on equities, and the question is if the same narrative is unfolding again.

The challenge here is that omicron likely wasn’t the only factor at play in the equity swoon, according to Peter Tchir, head of macro strategy at Academy Securities Inc. The other variables include less dovish central bankers and the fact that stock prices looked stretched on some measures.

“I wouldn’t be surprised to get a bounce as we decide omicron is manageable, but I would fade that bounce, as it isn’t all that is going on here,” Tchir said.

©2021 Bloomberg L.P.