Feb 17, 2022

Mass Testing Paves Way for Hong Kong Reopen, Stock Watchers Say

, Bloomberg News

(Bloomberg) -- Market watchers are optimistic that Hong Kong’s plans for mass Covid-19 testing could stem the resurgence of virus cases, with stocks tied to economic reopening advancing in a volatile session Thursday.

Leveling out daily infections could ultimately lay the groundwork for an eventual reopening - even if that seems far away, they say. Hong Kong is intensifying efforts as the latest outbreak rips through the city, with local media reporting about 5,000 new Covid cases on Thursday.

While broader markets in the financial hub and in Asia were whipsawed by renewed geopolitical tensions over Ukraine, shares of Macau casino operators and cosmetics makers climbed in Hong Kong.

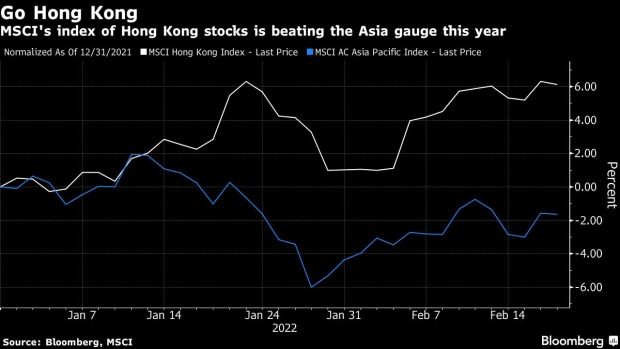

Further gains could help broaden the rise in the MSCI Hong Kong Index, which has rallied more than 8% since a December low, among the top-performing stock benchmarks in Asia. The advance was boosted by financials, which make up about half of the gauge’s weighting, amid a surge in global bond yields.

Here are some comments from market watchers and strategists:

Modular Asset Management

- “There is a silver lining - that the Hong Kong government is taking serious action to stabilize its outbreak - and asking for resources,” says strategist Wai Ho Leong

- “There is hope that the cases could stabilize quickly. And that is good for eventual reopening momentum, like what ASEAN and Singapore are doing”

DailyFX

- “The government is probably preparing the city for reopening after mass testing, but given that the cases are still surging, it’s just the first step in that direction. It could take some time before the city can really open its border,” says strategist Margaret Yang

- “China’s Covid-zero policy means Hong Kong-China reopening won’t be a near-term event to discount”

Bloomberg Intelligence

- “The mass testing represents a plan that could accelerate the end of the current wave. From that perspective, it’s better than lingering uncertainty,” says analyst Marvin Chen

- “Local Hong Kong economic conditions has some, but not a lot of impact on the local market. The more important ones are developments in China and globally, considering that the majority of Hang Seng Index members are mainland Chinese companies”

©2022 Bloomberg L.P.