Jan 11, 2019

May’s Denial Can’t End Dreams of Brexit Delay in U.K. Markets

, Bloomberg News

(Bloomberg) -- The government has said it won’t happen, but traders are keeping the dream alive.

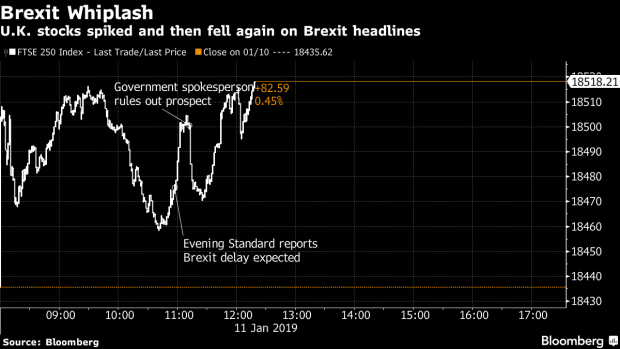

U.K. domestic stocks spiked along with the pound shortly before 11 a.m. in London on Friday as the Evening Standard reported that cabinet ministers are expecting Brexit to be delayed. Even the Stoxx Europe 600, usually less sensitive to never-ending Brexit headlines, jumped.

But about 20 minutes later, a government spokeswoman ruled out a postponement.

Judging from the market reaction, that wasn’t enough to dash investors’ hopes. As of 12:19 p.m. in London, the pound was trading 0.5 percent higher versus the dollar. The mid-cap FTSE 250 advanced 0.5 percent, while the FTSE 100 and Stoxx 600 both dropped about 0.1 percent. The U.K. large-cap benchmark tends to have a negative correlation with sterling.

While a delay to Brexit would only further heighten uncertainty, it would increase the possibility of a reversal and lower the odds of the U.K. crashing out without a deal. Anxiety over that outcome has grown recently as it becomes increasingly clear that Prime Minister Theresa May’s deal won’t make it through Parliament next week.

The usual suspects rose on Friday’s report, though the rally didn’t last for some of them. These include housebuilders such as Berkeley Group Plc and Redrow Plc; U.K. banks such as Lloyds Banking Group Plc and Barclays Plc; and other locally focused names like Royal Mail Plc and Babcock International Plc.

To contact the reporter on this story: Justina Lee in London at jlee1489@bloomberg.net

To contact the editors responsible for this story: Blaise Robinson at brobinson58@bloomberg.net, Celeste Perri, Paul Jarvis

©2019 Bloomberg L.P.