Jul 13, 2021

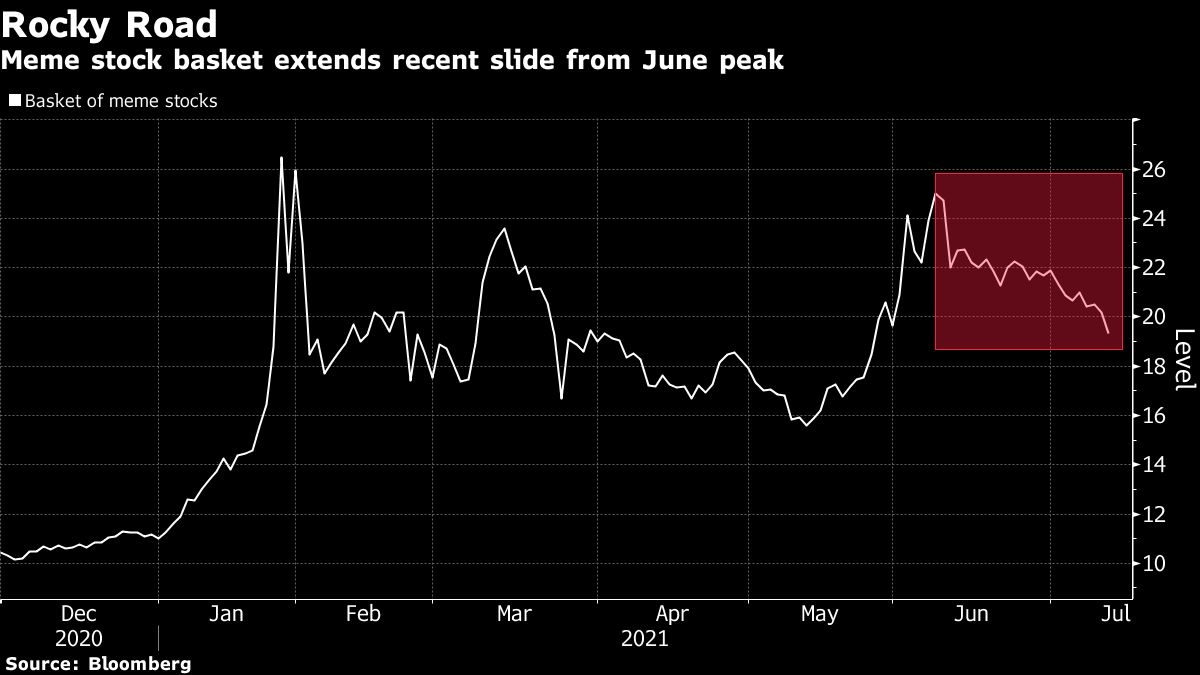

Meme euphoria fades as losses mount with 23% drop from June peak

, Bloomberg News

WallStreetBets retail traders are here to stay forever: Founder Jaime Rogozinski

A basket of retail traders’ favorite stocks of 2021 showed fresh signs of investor fatigue as the group extended losses past 20 per cent amid a rotation into large-cap tech names.

The group of 37 so-called meme stocks tracked by Bloomberg fell 4.2 per cent on Tuesday, marking a 23 per cent decline from a June 8 high. Recent high-flier Newegg Commerce Inc. and AMC Entertainment Holdings Inc. have tumbled 32 per cent and 15 per cent respectively this week.

The selloff suggests limits to the Reddit retail-trading phenomenon, which was defined by cash-rich investors pumping up the stock market and betting against short-selling hedge funds. The mania has delivered huge losses to the likes of Gabe Plotkin’s Melvin Capital Management and rich returns to those placing bets early in the frenzy.

The index’s most notable laggards from the June peak include Chamath Palihapitiya-backed Clover Health Investments Corp., GameStop Corp. and others like Zomedica Corp. and Koss Corp. which have each lost roughly 30% of their value. Only Newegg and U.S.-listed shares of Nokia have traded higher in July compared to a 1.7 per cent gain for the S&P 500.

The ever expanding and one-off mania of hunting for the newest meme stock has also hamstrung investors who have love to talk up their diamond hands. Trading volume for favorites like GameStop and movie theater AMC Entertainment have dried up in recent weeks.

“It is not helping that that the army of Reddit traders have widened the basket of meme stocks that they hold,” said Ed Moya, senior market analyst at Oanda Corp. “Tech stock have a valuation problem and that has many traders exiting their frothy positions, which especially include meme stocks.”