Apr 28, 2022

Meta shares soar as Facebook returns to user growth

, Bloomberg News

Meta shares soar as Facebook returns to user growth

Shares of Facebook parent Meta Platforms Inc. surged as much as 19 per cent on Thursday morning after the company reported its main platform added more users than projected in the first quarter, easing concerns that the company is losing momentum as a new generation flocks to younger sites like TikTok.

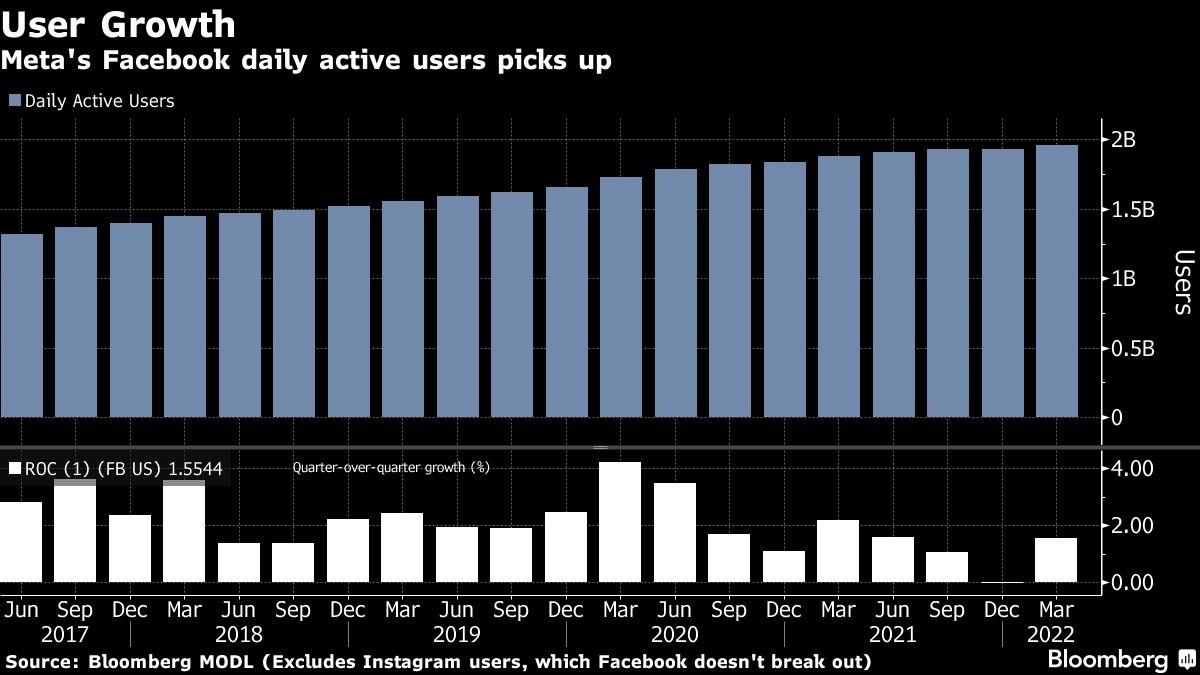

Meta on Wednesday reported 1.96 billion daily users for its flagship platform, a return to growth after the first-ever decline in the December quarter. Analysts had estimated 1.94 billion.

Revenue for the period jumped 6.6 per cent to US$27.9 billion, and would have been higher if not for the war in Ukraine, the company said. The stock had dropped almost 50 per cent this year as investors became increasingly worried that Meta’s main business and profit engine -- advertising in its social media feeds -- was losing steam.

Those concerns appear to have been put to rest -- at least for now -- given Facebook added 31 million new daily active users in the recent quarter. Still, many of Meta’s challenges remain. Chief Executive Officer Mark Zuckerberg has acknowledged that video-sharing app TikTok, owned by China’s ByteDance Ltd., is providing serious competition for young users’ attention.

Tom Champion, an analyst at Piper Sandler who rates the shares neutral, called the results “low drama,” and said that while the outlook for roughly flat revenue growth in the second quarter “would have been unthinkable a year ago,” it was better than the market feared.

The shares jumped to as much as US$208.20, the biggest intraday increase since July 2013.

At the same time, changes to data-collection rules on Apple Inc.’s iPhones have hindered Meta’s ability to serve users targeted ads. Last quarter, Meta executives said the privacy changes would reduce the company’s 2022 sales by US$10 billion. Advertisers have also been spending less due to issues with supply chains, inflation and the ongoing war in Ukraine, Meta executives said.

A prolonged slowdown would make it tougher for the company to justify Zuckerberg’s expensive, virtual-reality-fueled vision of the metaverse, a business that won’t bring in profit for years -- if ever.

On an analyst call Wednesday, Zuckerberg reiterated that it will be years before Meta’s Reality Labs unit, which is building AR and VR technology, will contribute meaningfully to its business. Meanwhile, the company has said it’s spending billions and hiring thousands of workers to develop the platform, which Zuckerberg sees as the next major computing shift, into a fully immersive digital environment where users will interact virtually while they work, shop and play games.

Shares of Menlo Park, California-based Meta climbed as high as US$210.14 in extended trading following the report. They had slipped 3.3 per cent to US$174.95 at Wednesday’s close in New York.

Net income in the first quarter was US$7.47 billion, or US$2.72 a share. Analysts had estimated earnings of US$2.56 per share. Sales in the current period will be US$28 billion to US$30 billion, Meta said Wednesday in a statement, compared with the US$30.7 billion analysts had predicted on average. Again, the company pointed to the ongoing war in Ukraine as a factor.

“This outlook reflects a continuation of the trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine,” the company said in the statement.

Meta said that in light of the revenue outlook, it is paring overall spending plans for the year, to US$87 billion to US$92 billion from a previous target of as much as US$95 billion.

On the call with analysts, Zuckerberg said Meta plans to launch its new virtual reality headset, code-named Project Cambria, later this year. The headset is meant to be used for work purposes as a replacement for a laptop, he added.

The company shocked investors in February when it said daily users for its core Facebook service declined slightly in the fourth quarter for the first time ever, raising the possibility that the main social network had peaked in popularity. The stock tumbled 26 per cent the next day, underscoring the concerns that people -- especially teenagers and young adults -- were defecting to newer platforms like TikTok, and that advertisers would follow.

In October, Zuckerberg had said that Facebook would focus on attracting “young people” to the service as a way to combat the rise of TikTok and other competing products. That meant prioritizing Reels, a TikTok copycat video format on Meta-owned Instagram and Facebook. While usage of Reels is growing quickly, the company’s advertisers haven’t been as fast to switch to the new format.

On Wednesday, Chief Operating Officer Sheryl Sandberg said on the call that making significant money from Reels will be “a multiyear journey” similar to the company’s efforts to make money from disappearing Stories.

Reels already makes up more than 20 per cent of the time that people spend on Instagram, Zuckerberg said. The company doesn’t give metrics for total time spent on Instagram or on its other apps, which include WhatsApp and Messenger.