Mar 30, 2023

Mexico, Colombia Leave Door Open for New Rate Hikes on Inflation

, Bloomberg News

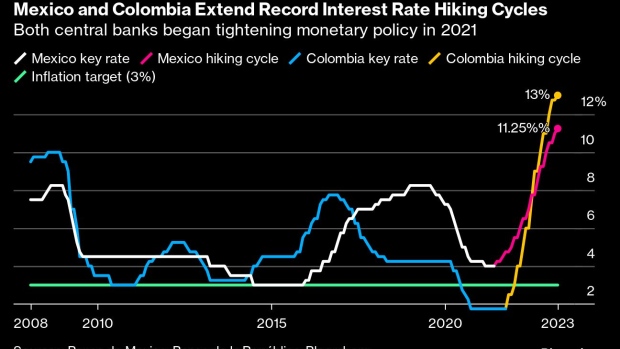

(Bloomberg) -- Mexico and Colombia, two of Latin America’s most hawkish central banks, are refusing to call a halt to their record monetary policy tightening cycles even after boosting rates again Thursday.

Both central banks matched the expectation of most economists and raised their key rate by 25 basis points each as they fight stubbornly high inflation expectations. Banxico, as the Mexican central bank is known, increased borrowing costs to 11.25% while Colombia hiked its benchmark rate to 13%. The decisions were both approved unanimously.

Read More: Mexican Peso Slips as Traders Bet on End of Banxico Hiking Cycle

While both nations are now closer to Brazil, Chile and Peru in ending the aggressive monetary policy response initiated in 2021 with the recovery from the Covid-19 pandemic, the banks’ post-decision communiques refrain from making that call explicitly.

Banxico, which has given forward guidance intermittently in the past, switched to data-dependent mode by saying its next decision will be contingent upon the inflation outlook, a message echoed by its Colombian peer.

“The successive decisions to be adopted by the board will depend on new available information,” Banco de la Republica, as the Colombian central bank is known, said in its statement Thursday.

Mexico’s swap rates sank and the peso trimmed its daily advance after the decision as traders expect policymakers will be less hawkish going forward. Colombia’s markets were already closed by the time of the announcement.

What Bloomberg Economics Says

“We expect policymakers to remain cautious, keeping the door open for additional moves if data warrant. We believe inflation dynamics in Colombia look more challenging and imply a higher risk of additional tightening or high rates for longer.”

— Felipe Hernandez, Latin America economist

— Click here to read his report on Mexico and here for his report on Colombia

Colombia and Mexico are home to the only top inflation-targeting central banks in Latin America that are still hiking after Brazil reached its terminal rate in August, Chile in October and Peru this January.

Yet, unlike Colombia, Mexico is finally seeing some positive news in the fight against inflation, with bi-weekly price gains decelerating to 7.12% in early March, the lowest in over a year. Core inflation, which excludes volatile items such as fuel, also slowed to 8.15% even if it remains far above Banxico’s target range.

“It was slightly less hawkish than what they published in February,” Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa, said about Banxico’s statement on Thursday. “This position shows that the board is recognizing that its monetary policy is already fairly restrictive, but leaving the door open to evaluate how inflation evolves.”

Alberto Ramos, the chief Latin America economist at Goldman Sachs Group Inc., still sees Banxico increasing rates once again at its next meeting May 18 but says such a likelihood is diminishing.

“We anticipate a likely final 25-basis-point rate hike,” he wrote in a research note, adding that “the subjective probability of a hike in May was reduced to 65% from 80%.”

Ver un video sobre esta nota en español

Colombian Inflation

In Colombia’s case, annual inflation kept accelerating in February to 13.28%, the fastest since 1999, driven by food and fuel price increases and indexation effects from high real wage gains.

That ranks as the fastest among major regional economies with the exception of turbulent Argentina, where inflation is now above 100%. However, pressures on the price of imported goods and services have eased somewhat after the peso advanced more than 4% in March to its strongest level against the dollar in two months.

Colombia’s decision takes its interest rate to its highest level since the bank implemented its inflation-targeting strategy in 2000. But it is also expected to be one of the last increases in the bank’s 11.25 percentage-point tightening cycle. Economists surveyed by Banco de la Republica forecast that rate hikes will end at 13.25% after the next meeting in a month.

“The inflation rate is approaching its ceiling, from where it would start its expected descent for 2023,” Governor Leonardo Villar told reporters after the bank’s meeting in Bogota. “Economic activity continues to be characterized by an important slowdown.”

Read More: Colombian Bonds Will Get a Major New Buyer, Finance Chief Says

--With assistance from Carolina Gonzalez, Rafael Gayol and Maria Elena Vizcaino.

(Updates with Goldman Sachs comments from 10th paragraph.)

©2023 Bloomberg L.P.