Mar 23, 2023

Mexico Inflation Slows More Than Forecast in Relief for Banxico

, Bloomberg News

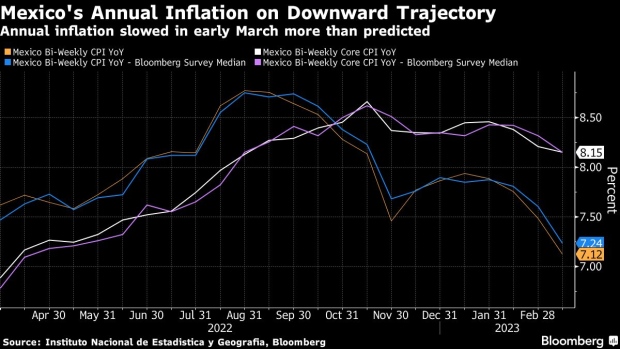

(Bloomberg) -- Mexico’s inflation eased more than economists expected in early March, likely boosting the odds that the central bank will slow a record monetary tightening cycle at next week’s meeting.

Consumer prices rose 7.12% in the first two weeks of the month from the same period a year earlier, down from 7.48% in late February, the national statistics institute reported Thursday. The reading was below the 7.24% median estimate of economists surveyed by Bloomberg.

Core inflation, which excludes volatile items such as fuel, was 8.15% on an annual basis, below the previous measure of 8.21% and matching economists’ estimate. The metric has been a concern for the bank’s five board members, according to the minutes their February meeting, when they stunned markets with a bigger-than-expected half-point hike.

The peso trimmed earlier gains after the data was released, weakening to 18.5832 per dollar. Earlier, the currency had reached an intraday high of 18.4506 per dollar.

“The data is good, but we cannot declare victory against inflation yet because the trends that worried Banxico the most, related to core inflation, are still there,” said Pamela Diaz Loubet, Mexico economist at BNP Paribas. “The print doesn’t change our view that Banxico will hike 25 basis points in its next decision.”

Banxico, as the central bank is known, has increased its key rate 700 basis points over 14 straight meetings to 11% and has recently acted more aggressively than other inflation-targeting banks in Latin America. It is expected to continue the record hiking cycle at its second meeting of 2023 next week. The items that most contributed to price gains in early March were air transport, limes and restaurants.

Read More: Banxico Still Mulling Smaller Rate Hike Amid Banking Turmoil

“The data that we’re seeing now supports the idea that the hiking cycle in Mexico is near an end,” said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. “It does make it seem likely this will be the last increase. There’s still a red flag related to the inflation of services, which could lead to an additional increase in May.”

Fed, Core Inflation

Federal Reserve policymakers on Wednesday voted unanimously to increase the bank’s target for the federal funds rate by a quarter percentage point to a range of 4.75% to 5%, the highest since September 2007. Fed Chair Jerome Powell made clear that more tightening may be in store and that the central bank will raise rates higher than expected if needed.

His comments led some analysts to double down on their predictions that Banxico would follow suit, though Banxico board members have repeatedly said that they consider a broad range of data when rendering their decisions.

“We’ll take into account the decision of the Fed and many other factors, to the extent that they affect the inflation panorama,” Banxico Governor Victoria Rodriguez Ceja told Bloomberg News last week.

Perhaps more importantly to Banxico next week will be the core inflation print reported Thursday. Deputy Governor Irene Espinosa said in a Bloomberg Television interview that core readings have been “very resistant to decline,” making clear that “sources of inflationary pressure are there and there is the need for an additional monetary effort.”

Economists in a survey published by Citi this week forecast that inflation would slow to 5.2% by the end of 2023 and 4.03% by the close of 2024. They also forecast that Banxico would raise rates by 25 basis points March 30.

--With assistance from Giovanna Serafim and Davison Santana.

(Updates with market reaction and economists’ comments starting in fourth paragraph.)

©2023 Bloomberg L.P.