Jan 27, 2021

'Unnatural, insane and dangerous': Michael Burry on GameStop rally

, Bloomberg News

GameStop Value Surges Past $10 Billion After Musk Tweet

Michael Burry’s bullish stance on GameStop Corp. in 2019 helped lay the foundations for an epic retail-investor frenzy. Now the famed fund manager is warning that the rally has gotten out of hand.

“If I put $GME on your radar, and you did well, I’m genuinely happy for you,” Burry, best known for his prescient bet against mortgage securities before the 2008 financial crisis, said in a tweet on Tuesday. “However, what is going on now – there should be legal and regulatory repercussions. This is unnatural, insane, and dangerous.”

Burry, whose investment firm reported owning a 2.4 per cent stake in GameStop as of Sept. 30, said in an email interview on Tuesday that he’s now “neither long nor short.” He declined to comment on when he sold the stock.

- GameStop skeptics Citron, Melvin succumb to epic short squeeze

- Short-sellers crushed like never before as retail army charges

- Reddit stock frenzy 'a sign of frothiness' in market fringes: CIBC's Dodig

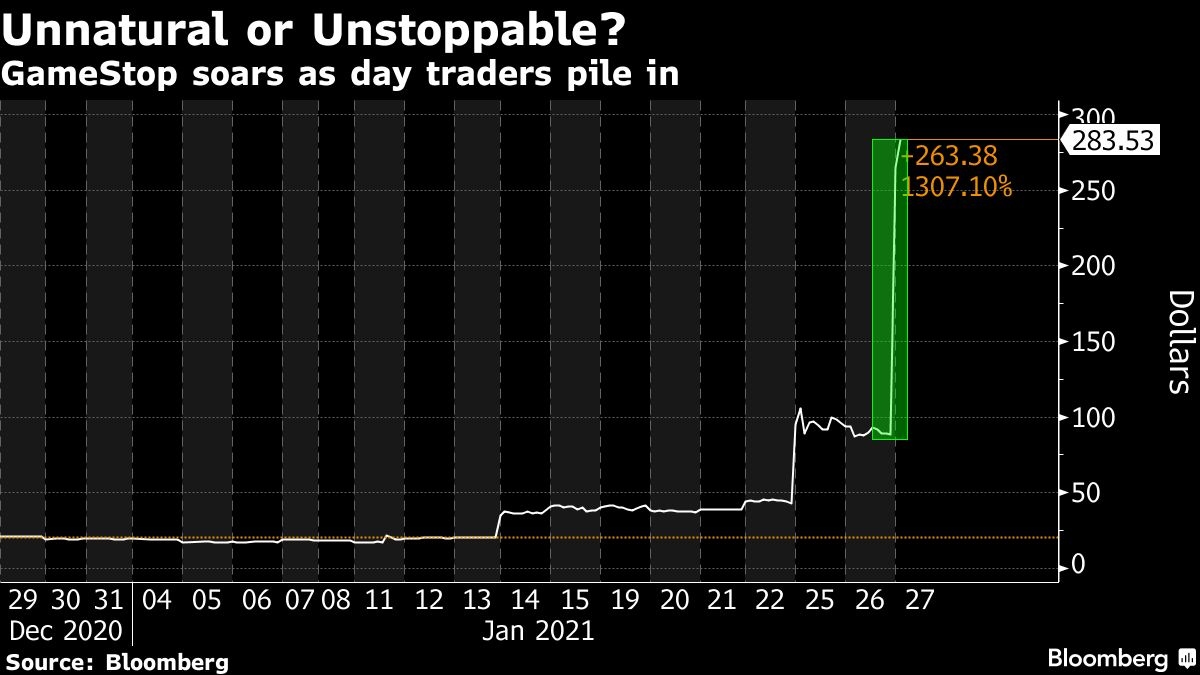

GAMESTOP'S WILD RIDE

Burry became a household name after his mortgage trade was featured in “The Big Short.” He helped draw attention to GameStop in mid-2019 after his Scion Asset Management unveiled a 3.3 per cent stake in the beleaguered video-game retailer and urged the company to buy back shares. Burry’s holding has been cited by some of the traders who’ve flooded online forums in recent weeks with posts imploring their fellow punters to buy.

GameStop’s 642 per cent surge since Jan. 12 has captivated Wall Street, elicited a tweet from Elon Musk and routed short sellers including Gabe Plotkin’s Melvin Capital and Andrew Left’s Citron Research. It has also spurred calls for a Securities and Exchange Commission investigation, though legal experts say it’s difficult to prove chat-room posts are part of an illicit scheme to manipulate the market.

Burry’s warning has so far done little to dampen retail investors’ enthusiasm: GameStop rose another 45 per cent in pre-market trading as of 8:38 a.m. in New York, though it had more than doubled in overnight trading.

WEIGH IN