Aug 31, 2018

Mike Philbrick's Top Picks: Aug. 31, 2018

Mike Philbrick, president of ReSolve Asset Management

Focus: ETFs

MARKET OUTLOOK

We’ve recently seen a meaningful increase in exposure to safe assets like bonds while maintaining risk on assets like stocks. This is diversification at its best.

This is due to the combination of the attenuation of the down trend in bonds and the varying effectiveness of bonds to diversify the portfolio. That is to say bonds look to be asserting a meaningful negative correlation to risk assets in the portfolio whilst establishing a more constructive positive trend.

Further, this is one of the core strengths of diversification. It's not about one or another asset class in isolation, but rather constructing a maximally diversified coherent portfolio based on more relevant observations of return, correlation and volatility estimates.

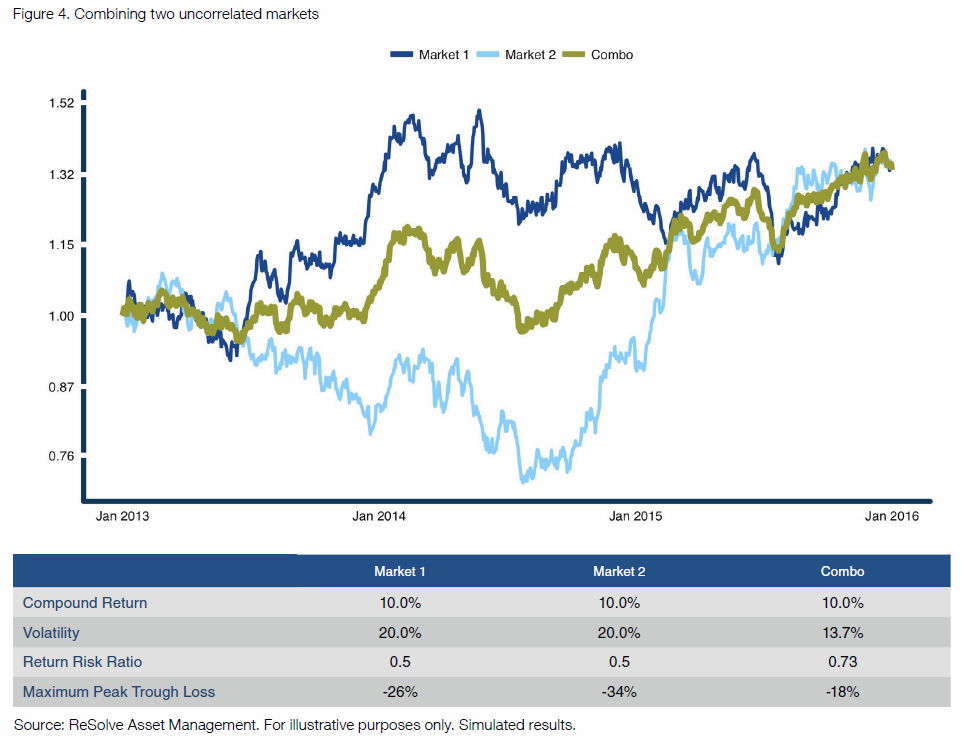

We cover the core tenets of this in our piece Skis and Bikes: The Untold Story of Diversification. Here is an example of how diversification can work its magic:

Above, we have two uncorrelated assets with equal expected return, volatility and Sharpe ratios. Note how much better the combo portfolio does.

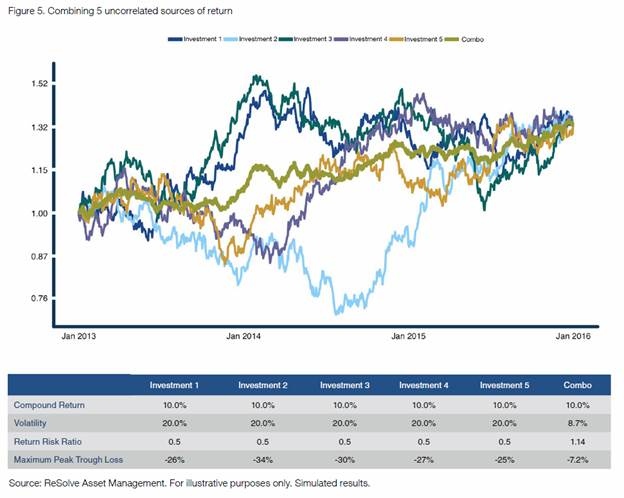

Expanding on this, below are five uncorrelated investments with equal expected return, volatility and Sharpe ratios. Note how the portfolio of these investments achieves the same return with less volatility, a higher Sharpe ratio and a lower maximum drawdown (only 8.70 per cent versus over 25 per cent for all of the individual investments).

That is the magic of non-correlation and diversification. Further, the journey counts: many investors are shaken out of investments during the periods of loss (drawdowns) thereby experiencing the risks of the investment/strategy, but not the returns.

TOP PICKS

ISHARES CURRENCY HEDGED MSCI JAPAN ETF (HEWJ.N)

Japan has excellent economic growth and valuations are reasonable. The Bank of Japan continues to support equities through purchases. For more diversification, a large global market, currency neutral, we’re seeing allocations to this in portfolios.

SPDR S&P AEROSPACE AND DEFENCE ETF (EQUAL WEIGHT) (XAR.N)

Trump signed a $717 billion defense spending bill, the biggest increase in a decade. This ETF is a different tech play (with drones and robotic soldiers). Excellent earnings and revenue growth.

INVESCO S&P 500 EQUAL WEIGHT INDEX ETF (EQL.TO)

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| HEWJ | N | N | N |

| XAR | N | N | N |

| EQL | N | N | N |

PAST PICKS: JULY 30, 2018

ISHARES MSCI CHINA A ETF (CNYA.N)

- Then: $27.20

- Now: $25.70

- Return: -6%

- Total return: -6%

HORIZONS ENHANCED INCOME INTERNATIONAL EQUITY ETF (HEJ.TO)

- Then: $6.40

- Now: $6.25

- Return: -2%

- Total return: -2%

ISHARES US REAL ESTATE ETF (IYR.N)

- Then: $79.88

- Now: $83.06

- Return: 4%

- Total return: 4%

Total return average: -1%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| CYNA | N | N | N |

| HEJ | N | N | N |

| IYR | Y | Y | Y |

TWITTER: @MikePhilbrick99

WEBSITE: www.investresolve.com