Feb 6, 2023

Miners, Self Storage Firms Reopen M&A Market in $40 Billion Rush

, Bloomberg News

(Bloomberg) -- A flurry of big deals in sectors ranging from mining to storage has provided respite for the world’s dealmakers after their slowest start to a year in two decades.

More than $40 billion in potential transactions came to light over the weekend and into Monday, according to data compiled by Bloomberg, as deal-hungry companies sought to start spending after a prolonged period on the sidelines.

US gold giant Newmont Corp. overnight announced the year’s biggest deal with a $17 billion offer for Australia’s Newcrest Mining Ltd. That came after Public Storage on Sunday made an unsolicited $11 billion bid for Life Storage Inc. in a move aimed at boosting profitability.

In Europe, the Rothschild family is planning to take its eponymous French bank private in a roughly €3.7 billion ($4 billion) deal, ending decades of public ownership for one of the most storied names in global finance. And CVC Capital Partners confirmed Bloomberg News reporting that it will take a majority stake in Danish transport company Scan Global Logistics. In doing so, the private equity firm has found a workaround that may help unlock buyout financing.

A number of other multibillion-dollar transactions could be on the cards on both sides of the Atlantic.

US life sciences company Danaher Corp. has expressed takeover interest in contract manufacturer Catalent Inc., which has a market value of about $10 billion, Bloomberg News reported on Saturday.

Meanwhile, French shipping tycoon Rodolphe Saade is ramping up his hunt for acquisitions, with an eye on fellow billionaire Vincent Bollore’s logistics arm as a way to take a greater slice of global trade flows, people familiar with the matter said.

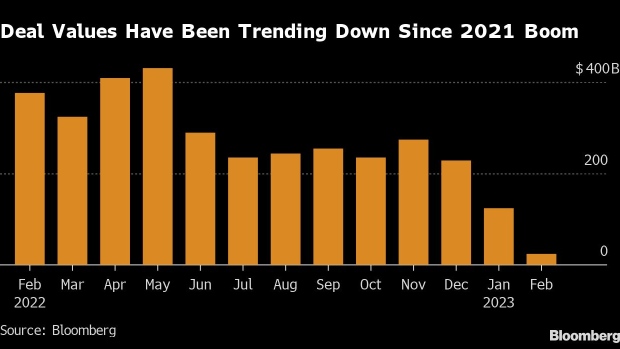

It all adds up to a much rosier picture for mergers and acquisitions following a super slow start to the year. At about $124 billion, global deal values in January were the lowest for an opening month since 2003.

Higher interest rates and a more risk-averse stance from traditional lenders have combined to put a squeeze on financing markets, making it harder for the buyout firms that fueled dealmaking during the boom years to buy new assets. There’s also the specter of greater regulatory scrutiny still in the background. The UK merger watchdog is expected to issue its preliminary findings in the coming days on Microsoft Corp.’s $69 billion takeover of Activision Blizzard Inc.

For now, though, the sudden flurry of activity is providing a welcome fillip for investment banks, which have been culling staff amid a big decline in fees. M&A volumes fell 31% last year to $3.7 trillion, while initial public offerings in many markets slowed to a standstill.

(Updates with additional context on dealmaking in last two paragraphs)

©2023 Bloomberg L.P.