Jun 17, 2021

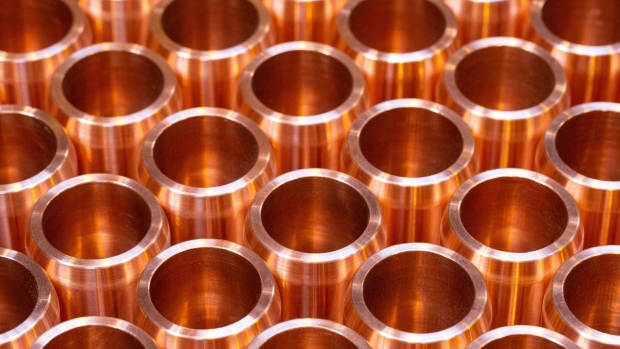

Mining Giant Opens World’s First Physical Nickel and Copper Fund

, Bloomberg News

(Bloomberg) -- A fund backed by Russian metals giant MMC Norilsk Nickel PJSC began offering exchange-traded commodities for nickel and copper on the London Stock Exchange, expanding options for investors.

The move comes amid growing interest in ETCs, which offer traders without direct access to spot or derivatives markets exposure to various commodities. The five largest industrial-metals exchange-traded products saw their biggest ever inflows in April.

“The new digital instruments are a great opportunity for investors to benefit from the rising demand for the base metals,” Anton Berlin, Nornickel’s sales chief, said Thursday in a statement. The new ETCs are the first physically backed nickel and copper exchange-traded products, he said.

READ: Investors Bet Billions That Metals Bull Run Isn’t Stopping

The Nornickel-backed fund’s ETCs are priced with a total expense ratio -- or annual cost to the investor -- of 0.85% for the copper security and 0.75% for the nickel product. That makes them the most cost-effective way for Europe-based investors to gain exposure to the metals, the company said. Both will track London Metal Exchange cash prices.

The fund is also the first ETC issuer to use blockchain distributed-ledger technology to record purchasing information, Nornickel said. The metal backing the ETCs is stored in secure warehouses in Rotterdam.

The launch comes as a chorus of banks and traders forecast a multiyear bull market for copper built on a looming surge in demand that could result in deep supply deficits. While Nornickel’s ETCs may expand market access for investors, consumers have railed against proposals for similar funds in the past.

Back in 2013, several major U.S. copper consumers lobbied the Securities and Exchange Commission to block the start of physical ETFs developed by BlackRock Inc. and JPMorgan Chase & Co., arguing that they would leave less copper available for manufacturers, worsening shortages and boosting prices.

Earlier this year, the Nornickel fund started trading precious-metals ETCs in Frankfurt and London. It also sold its first metals-backed digital tokens to industrial clients Traxys SA and Umicore SA in December. The company wants to eventually sell 20% of its output using the tokens, gaining greater flexibility as markets emerge from the coronavirus pandemic.

©2021 Bloomberg L.P.