Feb 21, 2019

Mixed Day for Indian Equities After Best Sensex Rally This Month

, Bloomberg News

(Bloomberg) -- Indian equities swung between gains and losses, after key stock gauges on Wednesday capped their best rally this month, as the run-up to national elections and uncertainty over which political parties will form the next government weighed on sentiment.

The benchmark S&P BSE Sensex was little changed at 35,763.91 as of 10 a.m. in Mumbai, after swinging between gains and losses about a dozen times. The NSE Nifty 50 Index was also little changed, at 10,732.10.

While India is expected to be among the fastest-expanding economy among major nations and company earnings are seen recovering from multi-year low growth rates, investors are waiting to see whether national polls expected in May deliver a government that continues with policies aimed at boosting spending and productivity.

Strategist Views

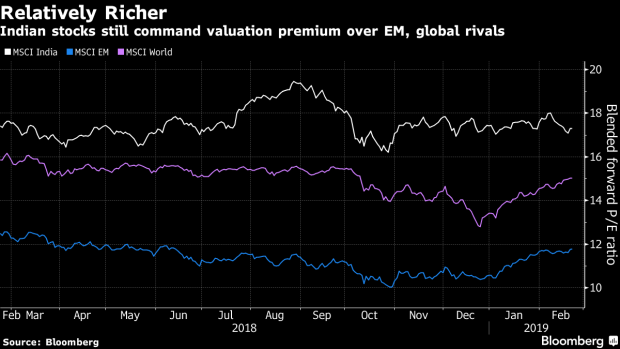

- “The Indian market is right now only about elections and election results,” said Vivek Ranjan Misra, head of equity research at Karvy Stock Broking Ltd. in Hyderabad. “We see a definite direction for equities and a possible out-performance over emerging market and global peers once this looming poll uncertainty is out of the way.”

- “We currently favor large companies over small-sized rivals amid the uncertainty,” he said, advising investors buy shares of banks and engineering and construction companies.

- Misra expects earnings at the 50 Nifty companies to rise nearly 10 percent on average in the financial year through March 31 and as much as 20 percent in the next.

The Numbers

- Twenty-nine of the 50 Nifty shares and 16 of the 31 Sensex stocks gained, paced by ICICI Bank Ltd.’s 2.4 percent rally.

- Fourteen of the 19 sector indexes compiled by BSE Ltd. advanced, led by the S&P BSE Basic Materials Index’s 0.7 gain climb.

- Corporation Bank jumped 16 percent, the most since October 2017, pacing a rally of 12 state-owned lenders after India approved an additional funding plan.

Analyst Notes/Market-related Stories

- Shree Cement Upgraded to Buy at CLSA; PT 19,000 Rupees

- Modi’s Farm Plan is ‘Wild Card’ in Tight India Polls, UBS Says

- India State Lenders May Move on $6.8B Capital Infusion Plan

- Britannia Raised to Outperform at Credit Suisse; PT 3,400 Rupees

To contact the reporter on this story: Ameya Karve in Mumbai at akarve@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Margo Towie, Anto Antony

©2019 Bloomberg L.P.