Oct 6, 2022

Modelo Beermaker Upbeat on Marijuana Partner Despite $1.1 Billion Charge

, Bloomberg News

(Bloomberg) -- Modelo beermaker Constellation Brands Inc. took a nearly $1.1 billion charge related to its stake in Canopy Growth Inc. in the second quarter -- but still sees catalysts that could lead it to boost investment in the marijuana industry.

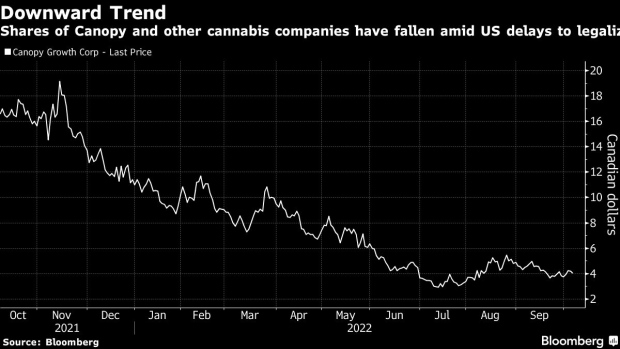

Constellation’s stake in the Canadian cannabis producer gives it an option to swoop into the space if US federal laws change, due to Canopy’s deals with US companies such as Acreage Holdings Inc., TerrAscend Corp. and Wana Brands that would trigger upon legalization. While Canopy’s shares have lost about two thirds of their value this year amid delays to US legislation, Constellation doesn’t plan any changes in its Canopy investment and supports the company’s strategy, executives said Thursday during a conference call.

“We are happy with the position that Canopy has in the US and with the improvements that they’re making in Canada,” Constellation Chief Financial Officer Garth Hankinson said. He cited Canopy’s plans to restructure Canadian operations, its choice of brand investments, and continued hope that the US will federally legalize marijuana, or allow banks to work with the industry.

©2022 Bloomberg L.P.