Oct 15, 2021

Moderate Democrats Ask Pelosi to Pause Global Minimum Tax Work

, Bloomberg News

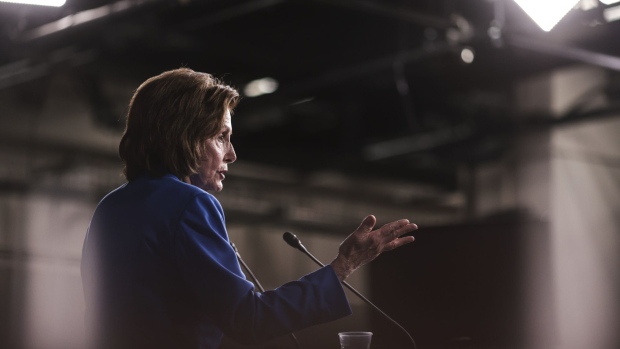

(Bloomberg) -- Three moderate House Democrats are asking Speaker Nancy Pelosi to slow down a piece of President Joe Biden’s tax plan that would change the rules for the minimum levies that U.S. companies pay on their overseas income.

The lawmakers are asking House leaders to wait on any change in international tax rules for U.S. companies until other countries implement an agreement to set a 15% minimum corporate tax rate. That deal, which also re-writes the rules for where corporations will pay their taxes, could take years to be enacted worldwide.

Effectively, the lawmakers are asking Democrats to remove the international tax changes included in the House Ways and Means Committee portion of a sweeping tax and spending bill written last month. That plan called for increasing the minimum tax on overseas earnings for U.S. companies -- also known as the global intangible low-taxed income, or Gilti, rate -- to 16.56%, from 10.5%.

“We must find a new pathway to ensure that we do not move before the rest of the world on implementing a new Gilti regime, and that we do not institute new rules of the road, like a country-by-country regime,” Representatives Tom O’Halleran of Arizona, Henry Cuellar of Texas and Lou Correa of California wrote in a letter to Pelosi and House Ways and Means Committee Chair Richard Neal. “These new rules in the ways and means draft would allow other countries to take advantage of our rules, and harm U.S. companies.”

Politico reported the letter from the moderate members earlier.

Differing Arguments

The global corporate tax deal, endorsed by finance ministers from the Group of 20 nations this week, calls for a 15% minimum, but allows countries to have higher rates. While the broad outline of the agreement has the backing of nearly 140 countries worldwide, the technical details still need to be written.

Eliminating the international measures of the Democrats’ tax plan would scale back the revenue that lawmakers are hoping to use to fund a major expansion in domestic social programs. The Gilti rate increase and related international changes would raise roughly $300 billion in new tax revenue, according to estimates from the Joint Committee on Taxation.

Neal has made the opposite argument to that of the three moderates -- saying that having a high-level international agreement gives the U.S. enough certainty to go forward with its own plans.

Democrats risk not being able to pass a higher global minimum tax in the future if they exclude it in the current bill, because they may not control Congress after the 2022 mid-term election. Many Republicans have said they oppose increasing the offshore rate.

Neal’s proposal for a 16.56% rate is a pared-back version of Biden’s earlier tax plan, which called for a 21% rate.

Democrats are hoping to pass a multi-trillion dollar tax and spending bill by the end of the year. The bill is largely funded by tax increases on corporations and the wealthy. Narrow margins in both chambers mean that Democrats need the votes of all their caucus members in the Senate and can only afford to lose three in the House.

©2021 Bloomberg L.P.