Feb 23, 2021

Momentum Trade Sinks as Bernstein Warns on Record Valuations

, Bloomberg News

(Bloomberg) -- One of the most crowded trades of this stock bull market is falling out of favor as bond volatility breaks out.

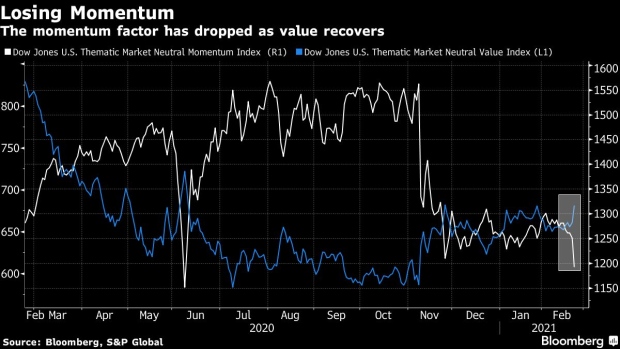

The momentum strategy -- which buys the past year’s winners and dumps the losers -- dropped 2% at the New York open after suffering its worst day in three months on Monday, a Dow Jones index shows. Investor darlings from Tesla Inc. to Cathie Wood’s ARK Innovation ETF dropped around 10% in early Tuesday trading.

As bonds sink on falling virus cases and expectations for a massive U.S. stimulus package, the investing style has become acutely vulnerable to the burgeoning reflation trade.

There could be more pain coming. Analysts have been upgrading the earnings forecasts of U.S. momentum stocks at the lowest rate since 1990, according to Sanford C. Bernstein, while valuations are at a record -- exceeding the peak of the dot-com bubble.

While the link remains hotly debated, the thinking goes that the momentum factor has essentially morphed into a bet on low yields given its current outsized exposure to Big Tech -- a sector that has soared through the pandemic.

“The parts of the market with a more negative correlation to bond yields trade at a premium to normal and those with a positive correlation trade at a discount,” strategists led by Inigo Fraser Jenkins wrote in a note. “This means that there is a lot of interest rate risk tied up in the relative valuation of stocks and hence a large amount of interest rate risk embedded in equity portfolios at present.”

Regardless of gyrations in the bond market, bulls would stress the tech behemoths are riding profound shifts in the global economy, powering the likes of Amazon.com Inc. and Netflix Inc. to lofty highs.

But there are straightforward reasons to think higher rates are a menace. As higher inflationary expectations push up Treasury yields, the long-term profits offered by these stocks are discounted at higher rates -- making the shorter-term cash flows from cyclical sectors look more attractive in comparison.

A sustained decline in momentum would have far-reaching effects in a stock market that has grown enamored with it. It commands $22 billion in exchange-traded funds -- with another $323 billion tied to equities seen offering strong profits, known as the growth factor. Red-hot investments like the ARK Innovation ETF are also famously sinking money into a slew of high-momentum stocks like Tesla.

And that’s not to mention its popularity within the quantitative community which tends to group stocks together by their characteristics, an approach known as factor investing.

Regime Shift

When market preferences change, a strategy like momentum which rides the current regime can be expected to crash. But this time, the risk is also exacerbated by its strong links to the rest of the equity landscape. Its positive correlation with the long-term growth factor is at the highest since 2000, while its link with value is the most negative in more than two decades, Bernstein data show.

With these links at such extremes, equity factors overall have become more sensitive to changes in macro forces, such as the recent reversal in bonds.

All the same, with the possibility that stimulus checks could spur fresh demand for these high-flying stocks, it isn’t the time to short momentum just yet, the Bernstein strategists conclude.

“The appropriate position is for investors to tactically neutralize their momentum positions,” they wrote. “Its valuation and anchoring to rates means that it could be very volatile.”

(Updates U.S. stock market moves in second paragraph)

©2021 Bloomberg L.P.