Oct 28, 2020

MoneyTalk: Four online banking tools seniors are embracing

Presented by:

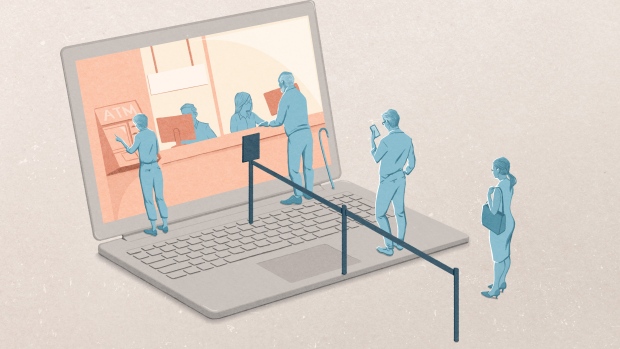

More seniors have turned to mobile and online banking during the COVID-19 pandemic. Here are four ways technology has made it easier than ever to manage your money safely at home.

Until the COVID-19 pandemic began, Heather Richardson’s parents, aged 65 and 72, banked like many other Canadian baby boomers — they went into their branch and talked to people face to face. They’ve always enjoyed these social interactions, whether chatting with an advisor about their investments or depositing cheques with their teller. And while they knew that banking technology might be more convenient, they weren’t sure how safe it was to use.

Then the pandemic happened, and they, like many others in their age group, realized it was time to re-evaluate the benefits of banking online. Fortunately, says Richardson, an assistant vice-president at TD Wealth, her parents quickly adapted to mobile and web-based banking. “They think it’s easy and they’ve accepted it’s safe,” she says. “They still have a relationship with individuals at their bank, too.”

According to a number of reports, Richardson’s parents aren’t the only seniors who have become more tech savvy since the COVID-19 pandemic began. A recent survey from Payments Canada, the non-profit organization that regulates digital payments in Canada, found that Canadians of all ages have embraced digital payments, with 62% saying they use less cash today than before the pandemic began, and 31% of weekly Interac e-Transfer users saying they now make virtual payments more than once a week.

As well, some U.S.-based data has shown that older individuals in particular are using more online and mobile financial technology, such as bank apps1 and virtual credit and debit cards2, when making payments and interacting with their bank.

Although seniors are making more use of financial technology, many may not be aware of just how much has shifted online since the COVID-19 pandemic began.

Here’s some of the technologies people have begun using more regularly during life under lockdown. In many cases, they’ve proven so helpful we expect they’ll be here to stay:

Video chatting with advisors

One of the more popular tools that much of the financial industry has adopted is video conferencing, says Richardson. Many of TD’s senior clients like face-to-face meetings with their financial advisors, and some were concerned about losing that personal touch during the pandemic. Fortunately, TD had rolled out video conferencing a year ago, so the company was able to deploy it to all of its clients quickly. In February, about 1,000 clients had meetings through TD’s video tool; in May, 25,000 virtual meetings took place. “People are happy they can still engage with their advisor on an emotional level,” she says.

COVID-19 Financial Relief

Where to find help

Signing documents virtually

As tech savvy as our society has become, many people still walk into their branches or their advisor’s offices to physically sign documents. Since March, however, many institutions have allowed clients to provide e-signatures on everything from account openings, investment trades and more. In May, the Ontario government amended a rule to allow people to designate beneficiaries on registered accounts via an e-signature. Thanks to these digital signing options, among the many other tech tools people now employ, Richardson is seeing a higher level of engagement from existing and prospective clients. “You can engage with an advisor or planner without having to leave home, dress up or worry about physical distancing,” she explains

Depositing cheques with a phone

Many baby boomers still receive cheques in the mail, whether it’s money from the Canada Pension Plan, dividend payments or their workplace pensions. While it’s still possible to have those dollars directly deposited into a bank account the traditional way, many have found that it’s just as easy — and safe — to use the mobile deposit feature on their bank’s app. Just take photos of the front and back of the cheque from the bank’s app and then follow the prompts to deposit the money into your account. Those dollars will show up moments later.

Paying digitally for almost everything

COVID-19 has proven that there’s almost no reason to transact with physical cash. Over the last few months, people have become much more comfortable with sending e-Transfers to friends and family, tapping their debit card over a point of sale machine or using a credit card stored in their phone’s digital wallet to buy something online. According to Interac, the interbank network that links financial institutions and other businesses, a record-breaking 61.3 million e-Transfers were sent by Canadians in April, while contactless Interac Flash transactions rose by 5% year-over-year. With more businesses no longer wanting to physically handle money because of COVID-19, and with more seniors getting used to paying for goods online and without cash, digital payments and transfers should only increase.

There’s a good chance that everyone will continue to use technology for their financial needs long after the pandemic ends. They’re now getting comfortable with the many tech tools available to them, and, says Richardson, they’re enjoying the convenience of banking from home. “The efficiencies that consumers and advisors have gained are tremendous,” she notes. “You don’t have to get in the car and fight traffic, and you can still look at someone in the eye.”