Nov 28, 2018

MoneyTalk: Mortgage conquered... So now what?

Presented by:

You’ve reached a huge financial milestone in paying off your mortgage. But what will you do with the extra money now flowing into your savings account?

Thaddus and Cecily* had just paid off their mortgage in the suburbs of Vancouver and they were glowing. They were 10 years away from a comfortable retirement and an end to years of daily commuting.

The lift they felt came honestly: After 23 years of paying close to $2,000 a month against their mortgage, the money was now flowing into savings. They were giddy with ideas on how to spend it.

The adrenaline was kicking in, too. The couple, who both worked in the medical device industry, were keen to refocus the extra money, along with the equity of their newly-paid-off home (estimated value: $1.1 million), to renovate their old family cabin. They hoped to turn their Sunshine Coast getaway into a custom-designed heirloom recreational property (estimated cost: $1.7 million).

Always frugal, the couple had a sense of pride that their hard work and discipline was finally paying off. The value of a newly renovated cabin, they felt, would grow by leaps and bounds over the years. It may be something their grandchildren would pass on to their own grandchildren.

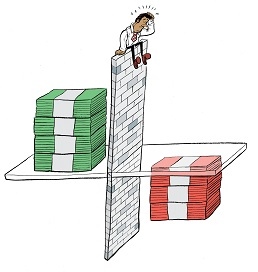

Unfortunately, events refused to accommodate their calculations. Despite the real estate boom, the market pulled back and Thaddus and Cecily’s home was appraised at just $800,000, which severely curtailed the equity they were counting on. Worse, a best-of-everything attitude had been driving their cabin reno and, a year into construction, it was still without a roof or windows, while the costs had climbed to $2 million. Slowly the satisfaction Thaddus and Cecily felt at being mortgage-free and the extra cushion they had in their savings was replaced by an anxious feeling that, so close to retirement, they may head into their golden years still in debt.

Owning a home and paying it off can take up a large portion of our working lives. In 2008, Canadians spent an average of 17% of their disposable income on mortgage payments. For many of us, twice-monthly payments are typical, and can add up to some 650 payments disappearing from our bank accounts over an amortization period of 25 years. Which is to say, crushing that mortgage is a huge financial achievement and one worth celebrating.

"Some people who are used to cash flowing in and out of their accounts aren't used to large sums of extra money just sitting there."

- DUGAN BATTEN, HIGH NET WORTH PLANNER, TD WEALTH.

An event like that can also tip us into some unfamiliar emotional areas. Polishing off one’s mortgage can naturally make us happy, rocket us into a more sound financial state and add some fuel-injection to our financial goals. Yet some people may find they feel adrift once they conquer this financial goal and may not know which financial priorities to take aim at next. Others, like Thaddus and Cecily, might find themselves getting carried away. With a personalized financial plan that accounts for your priorities and assumptions, home owners might avoid the problem of extra riches leading to new headaches.

If your last payment is on the horizon, congratulations! As you’re planning for the event, here are some things to consider.

Get ready for the big day

Dugan Batten, a High Net Worth Planner with TD Wealth, says people may feel euphoric when the day arrives to finally make the last payment.

“They may feel a sense of power but also a sense of uncertainty over their options,” he says.

“One thing I have learned is that some people who are used to cash flowing in and out of their accounts aren’t used to large sums of extra money just sitting there; if they see it, they may feel a strong urge to spend it.”

Extra money can push even the most even-minded among us into uncharacteristic behaviour, like teenagers with their first real paycheque rushing off to the mall. Dilip Soman, Professor of Behavioural Science and Economics at the Rotman School of Management at the University of Toronto, says how people react to a sudden influx of money is the subject of academic studies.

Paying off the mortgage has similarities to a windfall situation like a surprise inheritance or a lottery win and studies indicate that people spend windfalls more generously than money they've earned. At the same time, people can be vulnerable to making bad decisions because their emotions run high, Soman says.

17%

- Portion of disposable annual income Canadians contribute on average to mortgage payments.

Academic evidence has shown that finding yourself $500 richer by winning a small jackpot can give you a feeling of pleasure, and the winnings can help you pay for an unplanned night out or a surprise gift to a loved one. But like trying to walk straight after the tea-cup ride at the amusement park, making the decision to direct the money into a savings account or using it to pay down debts may prove difficult, even if you believe it's the most responsible option.

Paying off the mortgage is not quite the same as a windfall, says Soman. Like a tax refund, it's a welcome event, but not an unexpected one. We can plan for the day many years beforehand, and the money we receive is not winnings but actually ours, even if we may mentally treat it differently. The emotional jolt of extra money may leave us vulnerable to actions outside our normal behaviour — perhaps actions harmful to our wallets.

The mental accounting people do when perceiving gains and losses of money is also a study of behavioural finance. Richard Thaler, winner of the 2017 Nobel Prize in economics, describes how we mentally compartmentalize funds even if it is detrimental to our well-being — in the same way one might buy a pair of expensive shoes but never wear them in case they become damaged.

Mental accounting and our money

Mental accounting and our money

In his article, "Mental Accounting and Consumer Choice," Richard Thaler cites an example of a couple who has saved $15,000 towards buying a cabin, yet takes out an $11,000 car loan for a new vehicle.

Logically, the couple should use the cabin funds to pay down the car loan so that they incur as little interest as possible and help to prevent the real cost of the car from rising. But people may often believe that, having put effort into saving for an established goal, draining the account will slow their progress towards the cabin purchase. In reality, paying interest on the car loan could be the factor that can slow down their savings progress, since paying interest over time may limit their ability to save.

Similarly, people who have paid off their mortgage may view the extra money they get every month as separate from their overall cash-flow, to manage or spend at their whim.

Celebrate the occasion (sensibly)

Batten says that while it may be natural for people to feel euphoria in finally crushing that mortgage, they shouldn’t actually develop an emotional attachment to the funds or earmark the money as “special” in some way, because it can distract people from using those funds to accomplish financial goals.

But if a monthly $2,000 surplus in the bank means the difference between dreaming of a sailboat and actually hoisting the sails, isn’t that what working all your life is about?

There is no problem rewarding yourself, says Batten, and he often tells people to consider treating themselves when the lucky day comes. But he says everything must be done in moderation. A couple weeks in Europe can be a well-deserved reward of 30 years of payments. But it’s when the trip turns into a month and then a year, then it may become a problem. When people become accustomed to spending money lavishly because they think they’re entitled to it, even while they still have expenses and debt, it sets off alarm bells for Batten.

The key may seem boring compared with shopping for sports cars but Batten tells people to consider evaluating where you are with your other financial and life goals, and decide whether it’s time to set new ones based on your new saving power, well before the final payment day comes.

Return to your broader financial plan

Batten says that while the long-awaited dream trip to Europe or Africa might be on the agenda, people might also consider paying off other debts they may have, such as a car loan, or adding to their RSPs and TFSAs. They can also consider re-evaluating whether their long-term financial and retirement plans are on track and whether they can cover changing health conditions when they can no longer live on their own. Once people feel comfortable about their own retirement needs, they may also consider building their estate for their kids and grandkids or contributing to their favourite charities.

Batten says people also tend to do home renovations they have put off because of their mortgage, which can both allow themselves a chance to “treat” themselves and may also add value to their property.

But wherever people are inclined to spend or invest their extra cash, clearing the mortgage hurdle is a major financial milestone, but perhaps not the only one. It can be a great time to look around, aim for your next financial target and check in with your advisor and other professionals. They may be able to help ensure your financial aims are addressed and also help you to reward yourself for your decades-long determination in achieving a mortgage-free home.

*Based on a true story. Names and identifying details have been changed to protect privacy.