May 10, 2017

Moody's downgrades Canada's Big 6 banks on consumers' debt burden

The Canadian Press

TORONTO -- Moody's Investors Service has downgraded Canada's six big banks as it raised concerns about growing consumer debt and housing prices.

The debt-rating agency issued a report saying it expects TD Bank (TD.TO), Bank of Montreal (BMO.TO), Scotiabank (BNS.TO), CIBC (CM.TO), National Bank (NA.TO), and Royal Bank (RY.TO) to face a more challenging operating environment for the remainder of this year and beyond.

Moody's downgraded the baseline credit assessments, the long-term debt and deposit ratings, and the counterparty risk assessments of the banks and their affiliates by one notch. TD was the only exception, as Moody’s affirmed the bank’s counterparty risk assessment.

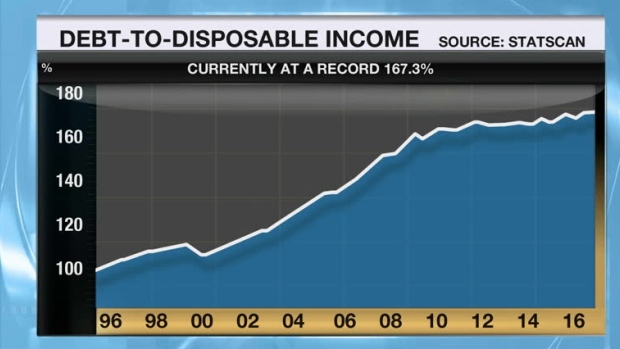

The report’s author pointed to elevated private-sector debt that amounted to 185 per cent of Canada’s gross domestic product at the end of 2016.

“The credit conditions in Canada continue to deteriorate. Our primary metric is looking at private debt-to-GDP,” David Beattie, a Moody’s senior vice president told BNN on Thursday. “It has gone up significantly over the last year and the rate at which it is increasing on a three-year basis has also gone up.”

“So, when we looked at that in comparison with other countries around the world, we just felt that we had to take action on Canada’s operating environment measure.”

Moody’s also maintained its negative outlook for the relevant ratings on the six banks.

The agency said the downgrade reflects its ongoing concerns that expanding levels of private-sector debt could weaken asset quality in the future.

It said growth in Canadian consumer debt and elevated housing prices leaves consumers -- and the banks -- more vulnerable to downside risks facing the Canadian economy than in the past.

“Everybody is focused on elevated house prices and high debt-to-income,” Beattie told BNN. “We quite frankly would be more concerned about non-real estate-secured consumer debt were stress to happen.”

“In any system, when you add leverage the susceptibility to event risk and the possibility of a bad reaction to some sort of stress in the environment increases. Consumer balance sheets have just not been tested at this high level of leverage at this point.”

- with files from BNN.ca