Jun 12, 2020

Morgan Stanley cuts Tesla to underweight on growing China risks

, Bloomberg News

Notable Calls: Tesla, Spin Master and Mullen Group

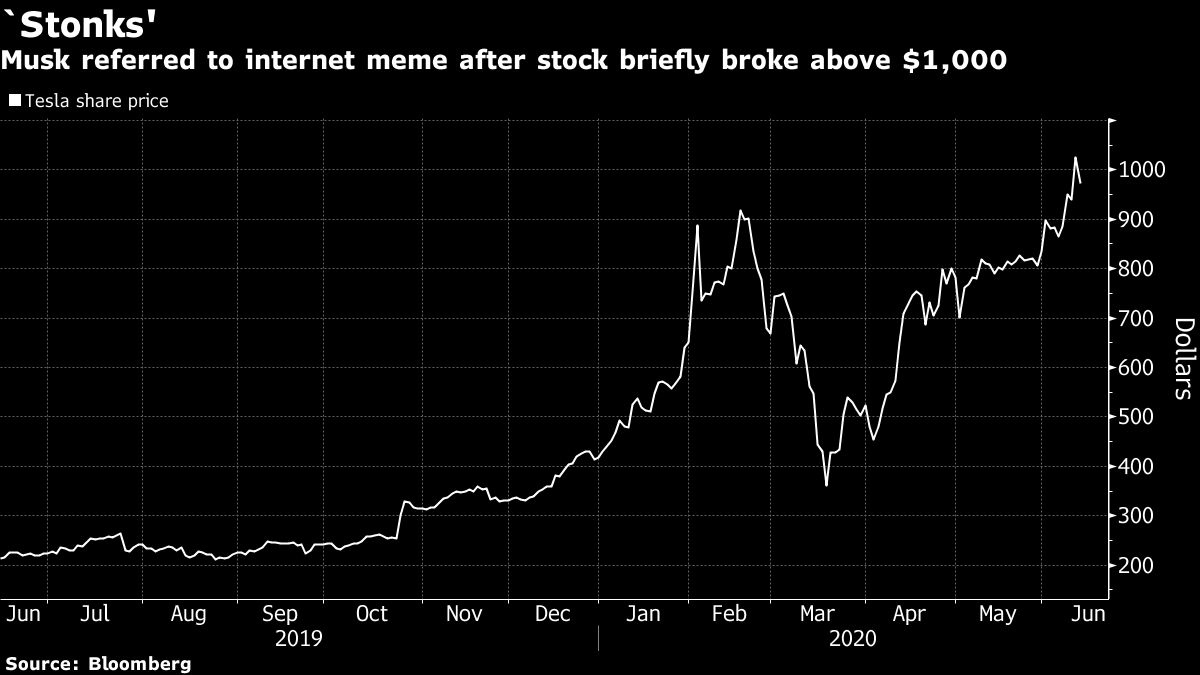

Morgan Stanley cut Tesla Inc. to underweight from equal-weight, saying the rally that saw the stock break above US$1,000 this week doesn’t properly reflect emerging risks.

Analyst Adam Jonas cited price cuts across Tesla’s model range in China and the U.S., suggesting light vehicle markets aren’t coming out of the coronavirus pandemic as strong as before. An even greater threat to the Palo Alto, California-based firm’s valuation, meanwhile, is a simmering trade row between Washington and Beijing.

“Among the many risks facing Tesla at this time, we would rank risks related to U.S.-China relations at the very top,” Jonas wrote in a note to clients. The bank warned last month that strained ties between the world’s largest economies could limit gains for Tesla shares, with China seen accounting for almost 30 per cent of the company’s volume this year versus about 13 per cent in 2019.

Demand in China and the lifting of coronavirus lockdowns in the U.S. and elsewhere have been cited as catalysts for the latest jump in Tesla’s stock. After closing above US$1,000 a share Wednesday, the shares retreated back below that level Thursday to US$972.84. Morgan Stanley’s US$650 price target, trimmed from US$680, suggests about 33 per cent downside.

Tesla Chief Executive Elon Musk weighed in on the valuation debate this week, tweeting the phrase “stonks,” an internet meme that’s often used to refer to the irony or absurdity of equity markets.

Morgan Stanley also highlighted Amazon.com Inc.’s reported interest in autonomous vehicle maker Zoox Inc. as an indication that the world’s largest technology firms should be seen as competitors rather than partners.

“Many investors we speak with describe Tesla as the ‘Amazon of Autos.’ But we’re asking: What if Amazon is the Amazon of Autos?,” Jonas wrote.

The Morgan Stanley analyst said that among the risks to his latest call on Tesla, he may be underestimating the company’s longer-term China growth prospects. Separately, revenue from the company’s “internet of cars” network could drive better-than-expected margins, he added.