Nov 21, 2022

Morgan Stanley Downgrades Brazil as Lula Imperils Value Play

, Bloomberg News

(Bloomberg) -- Morgan Stanley is moving to the sidelines on Brazil’s equity market as President-elect Luiz Inacio Lula da Silva’s appetite for increased spending risks derailing expectations for interest-rate cuts next year.

Brazilian stocks were reduced to neutral from overweight in the bank’s Latin America portfolio as strategists led by Guilherme Paiva flagged the risk of Lula naming an unorthodox finance minister and the Selic rate remaining higher for longer under a scenario of loose fiscal policy.

If that materializes, “the next few years should be good for Brazilian fixed income assets, but not for equities,” Paiva writes. “Higher real bond yields should undermine the apparently attractive valuation story for equities.”

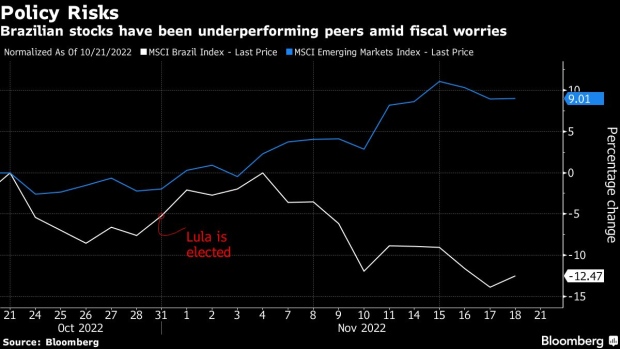

Brazilian stocks are trading at 6.8 times forward earnings, well below their ten-year historical average of 11.4 times, amid concern Lula will pursue fiscally profligate policies in Latin America’s largest economy. While local markets held up well for most of the electoral period, they are underperforming peers since the leftist leader was elected last month.

Morgan Stanley had been recommending that clients adopted an overweight exposure to Brazil since October of 2018, when Jair Bolsonaro emerged to power pledging to deliver on a liberal agenda of economic reforms.

The Ibovespa index is likely to end 2023 at about 125,000 points, suggesting room for a 15% gain from Friday’s close, according to the bank. Speaking at a Bloomberg event last week, central bank Governor Roberto Campos Neto said it’s too early to celebrate winning the fight against inflation and that policy makers will react if price-growth doesn’t slow toward target.

Brazil’s Ibovespa was up 1% at 11:05 a.m. local time Monday, trimming its month-to-date losses.

Morgan Stanley also took the chance to upgrade Mexico to overweight on its ties to the US economy, which is expected to avoid a recession in 2023. The Mexbol index will likely finish next year at 70,000, up 36% from Friday, as the country could benefit from companies moving production closer to customers -- so-called nearshoring -- the bank says.

Names on Morgan Stanley’s list of top Latin American stock ideas include MercadoLibre Inc., Itau Unibanco Holding SA, Porto Seguro SA, Sendas Distribuidora SA, Weg SA, Vale SA, Americanas SA, Fibra Prologis, Grupo Aeroportuario del Centro Norte SAB (OMA) and Credicorp Ltd.

(Adds context in fifth paragraph and market move in seventh.)

©2022 Bloomberg L.P.