Jul 21, 2022

Morgan Stanley Sees Indonesia Rupiah Languishing at Two-Year Low

, Bloomberg News

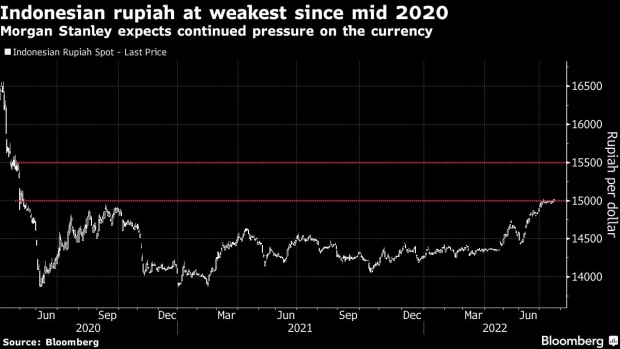

(Bloomberg) -- Indonesia’s currency may languish at its weakest level in more than two years as capital outflows accelerate and a dovish central bank lags behind its peers.

That’s the view of Morgan Stanley strategists, who see the currency trading between 15,000 to 15,500 per dollar. The call came in a note dated Wednesday, just ahead of the rupiah weakening to 15,025 per dollar in the lead up to Thursday’s Bank Indonesia policy decision.

Twenty-two out of 36 economists surveyed by Bloomberg expect the central bank to keep its benchmark rate unchanged at 3.5%.

Morgan Stanley see a risk the rupiah could even breach 15,500 if Bank Indonesia lags too far behind the pace of the Federal Reserve when it eventually starts to hike.

BI this week disclosed that it has started to reduce its debt holdings bought during the pandemic on an ad-hoc basis, a sign that it may be getting closer to raising its benchmark rate.

Read More: Indonesian Yields Rise as BI’s Bond Sales Fuel Rate-Hike Bets

©2022 Bloomberg L.P.