Jan 28, 2022

Mortgage Bond Weakness Threatens the U.S. Corporate Debt Market

, Bloomberg News

(Bloomberg) -- The U.S. corporate bond market is relatively calm so far about the Federal Reserve’s plans to start tightening the money supply in March, but pain for the debt could be coming from an unlikely source: home loans.

Most of those mortgages get bundled into bonds backed by U.S. government agencies, securities that have been weakening since November as money managers prepare for the Fed to slow down its purchases of them. The central bank is the biggest single buyer of mortgage-backed securities now.

Once mortgage-backeds get cheap enough, investors might start snatching them up again, selling shorter-term investment-grade company debt in the process, according to strategists and money managers. While gauges of credit risk are still far below pre-pandemic levels, any selling could result in more weakness for corporate notes that have already lost 3.2% in 2022 through Thursday, on track for their worst month since March 2020 at the start of the pandemic.

“Weaker mortgages are going to bleed into other sectors,” said Adam Rizkalla, an associate portfolio manager at Thornburg Investment Management. “Other investors are probably going to take a similar approach that we take, which is to lean into agency mortgages when they look cheaper, at the cost of investment-grade corporates.”

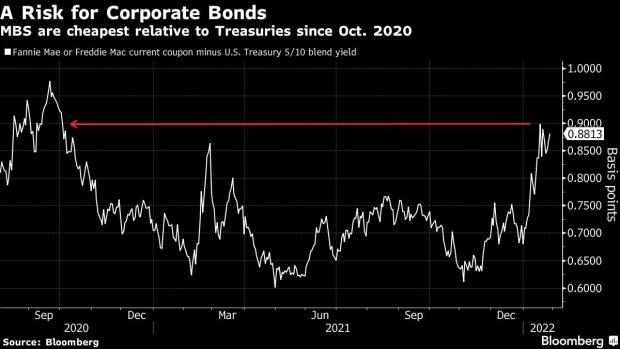

Mortgage bonds are hovering close to their cheapest levels since October 2020, based on the difference between yields on current coupon mortgages and a blend of five- and 10-year Treasuries. That risk premium was around 0.88 percentage point on Thursday, after averaging 0.7 percentage point last year.

Steve Kane, co-chief investment officer at $266 billion asset manager TCW Group, says widening MBS spreads are already making the securities compelling relative to corporate bonds.

“We like agency mortgages,” Kane said. “Unlike corporate credit, they’ve underperformed Treasuries for a lengthy period of time, the last year, as rates have been volatile and the market is anticipating the taper.”

Read more in this week’s Credit Brief: Mortgage Threat; Why Refinance?

To other investors and strategists, mortgage bonds aren’t yet a clear bargain. During the early part of the last tightening cycle, the current coupon spread over Treasuries was closer to 1 percentage point, and levels could widen further from here.

“Barring a large change in MBS supply, we don’t believe that mortgages have sufficient enough value that would lead one to switch from investing in corporates to mortgages yet,” said Michael Vranos, chief executive officer of hedge fund manager Ellington Management Group. “It doesn’t stick out as an obvious switch to make now, and the technicals of the Fed wouldn’t compel you to jump all in.”

Investor Shift?

Even if money managers aren’t yet buying the securities en masse, corporate bond investors face potential trouble from cheaper mortgage backeds.

“The risk is that wider mortgage spreads becomes a negative for short-end corporates,” JPMorgan Chase & Co. strategists led by Eric Beinstein wrote in a report this month. “If the Fed stepping back causes mortgage spreads to look quite cheap vs. their historical range while HG bond spreads are tight, it is logical to expect some investors to shift from corporates to mortgages.”

Predicting how much more mortgage bonds will widen and when is the tough part, in part because it’s not obvious exactly when the Federal Reserve will start cutting its holdings. The Fed made it clear that it will primarily hold Treasuries rather than mortgage securities in the longer run as it cuts portfolio holdings. The central bank has about $2.7 trillion of mortgage backed securities on its books, in an agency MBS market of more than $9 trillion, and it said it intends to stop buying new securities on a net basis in early March.

But even if the Fed’s holdings stop growing, that doesn’t mean they will start shrinking: the central bank will keep reinvesting principal payments that it receives from mortgage bonds.

“The big unknown is when the Fed’s roll off of its mortgage bond holdings is going to start,” said Christopher Maloney, mortgage strategist at BOK Financial. “It’s hard to price it in if you don’t know what the pace is going to look like.”

Looming Difficulties

It’s not clear how hard corporate bonds will be hit by any mortgage weakness. Historically, mortgage bonds and corporate bond spreads have been fairly closely correlated. But this time around, the Fed is unwinding its balance sheet, creating a strong headwind for MBS that other securities don’t have, said Bloomberg Intelligence analyst Erica Adelberg.

“Spreads tend to widen as the Fed reduces the size of its mortgage holdings because there’s more effective supply that needs to be absorbed,” Adelberg said regarding mortgage backed securities. Whenever investors do decide to buy those bonds, they might decide to sell Treasuries instead of corporates, she said.

Even so, there are other looming difficulties for corporate bonds. Barclays Plc strategists say that the growing risk aversion visible among equity investors could be coming to company debt markets as total return losses continue.

“The bigger fallout in credit could be to come,” Dominique Toublan, the bank’s head of U.S. credit strategy said. “Spreads being unchanged and yields this much higher will lead to negative total returns. We will pay careful attention to the fund flows in the coming days to see if this causes outflows.”

©2022 Bloomberg L.P.