Jun 13, 2021

Most Middle Eastern Stocks Climb as Oil Extends Gains: Inside EM

, Bloomberg News

(Bloomberg) --

Most equities markets in the Middle East extended gains on Sunday, following another positive week for crude prices.

Equities gauges in Saudi Arabia, Bahrain, Oman, Kuwait, Qatar and Israel advanced as much as 0.8%, while those in Dubai and Abu Dhabi slipped less than 0.1%.

Oil, the main export for Gulf countries, posted its third straight weekly rise on improving demand, with the International Energy Agency warning the market will need extra supply next year. Brent crude futures rose 1.1% for the week that ended June 11 to $72.69 per barrel, the highest since April 2019.

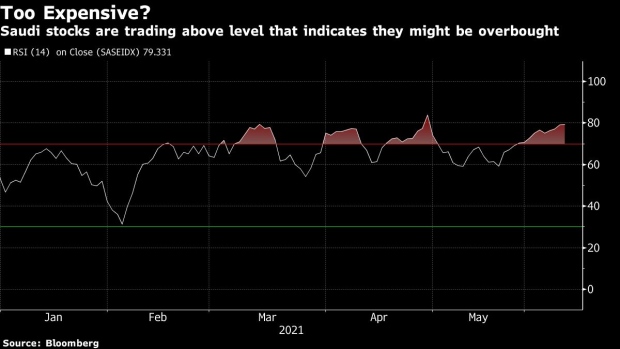

As Saudi stocks keep rising, a technical measure shows the Tadawul All Share Index has been trading in overbought territory for the past two weeks. The gauge is up about 25% for the year, versus a 7% advance for the MSCI Emerging Markets Index.

Israel’s TA-35 rose as much as 0.8%, heading for its third day of increases, as lawmakers are set to vote on a coalition that has conflicting ideologies but is united in ousting Prime Minister Benjamin Netanyahu. The index is up 14% this year.

MIDDLE EASTERN MARKETS:

Dur Hospitality and Taiba Investment climb 0.6% and 0.3%, respectively, as of 10:05am in Riyadh

- The companies are starting primary discussions for a merger, according to statements to the Saudi exchange

- READ: Saudi Arabia’s Taiba, Dur Start Talks to Form $2.4 Billion Firm

- Jabal Omar, which owns hotels in the holy city of Mecca, falls 0.8% after Saudi Arabia said it will only allow nationals and residents to attend the annual Hajj pilgrimage for the second year in a row, seeking to contain the spread of the coronavirus and its variants

- NOTE: Flagship hotels owned by Jabal Omar in Mecca include the Marriott, Hilton Suites, Hyatt Regency and the Conrad, all at privileged locations near the Grand Mosque

- Kuwait’s Premier Market Price Index rises 0.4%, heading for the 10th increase in eleven sessions

- Weakening credit quality suggests the top 10 UAE lenders’ nonperforming loans could increase by at least 2-3 percentage points, Bloomberg Intelligence analyst Edmond Christou writes

- Cost of risk of 140 basis points to drive loan restructuring at large-to-mid-sized accounts and impairment risk for smaller credit

- READ: UAE Banks’ 2H Focus Is Lower CoR, Better Credit Yields, Growth

- MORE: Iran Casts Doubt on Reviving Nuclear Deal Before Its Election

©2021 Bloomberg L.P.