Feb 21, 2019

Most Volatile Major Currency Lives Up to It in Just One Morning

, Bloomberg News

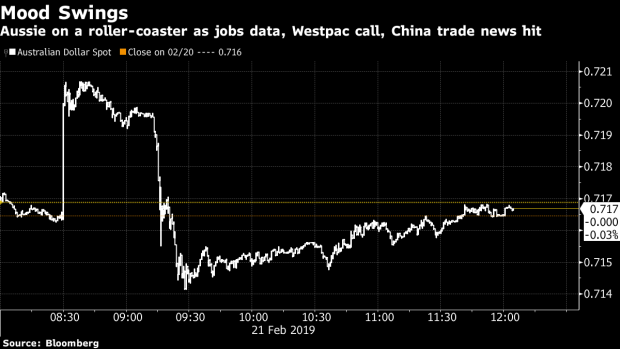

(Bloomberg) -- The Australian dollar is showing why it’s the world’s most volatile major currency in the past month, swinging almost 1 percent in two hours.

This is how Thursday’s events unfolded: the Aussie soared 0.6 percent on a surprise beat on jobs data, forcing traders to close short positions. Just 42 minutes later, it plunged when an influential economist at Westpac Banking Corp. said the central bank may cut rates twice. With fast-money accounts seeking to build new shorts, Reuters reported that the U.S. and China are drafting outlines for a possible trade deal, boosting risk-on sentiment and the Aussie with it.

“Australia is being caught as a half-Chinese, half-Western economy, and with greater decoupling to come the Aussie is going to be pulled in different directions,” said Michael Every, head of Asia financial markets research at Rabobank in Hong Kong. “The glide path is lower and lower for the Aussie but with huge, huge swings as you go down.”

Australia’s dollar has been caught in a tug-of-war with competing factors whipsawing a currency sensitive to global economic uncertainties. Hedge funds and speculative investors have ratcheted up bets in both directions amid the ongoing U.S.-China trade war, a central bank turning dovish and signs of a reversal in iron ore prices.

The Aussie had advanced to as high as 72.07 U.S. cents Thursday morning, before dropping to 71.42 cents. It’s little changed at 71.67 cents as of 3:05 p.m. in Sydney. Some macro funds that saw Westpac’s call ditched the currency when it reached the 71.80 U.S. cents mark, according to an Asia-based foreign-exchange trader.

Read: Hedge Funds in Tug-of-War With Most Volatile Major Currency

For traders, this confluence of factors will only mean more opportunities to trade the Aussie.

“With no regulators actively interfering, this will just mean a more volatile currency,” Every said.

To contact the reporter on this story: Ruth Carson in Singapore at rliew6@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Andreea Papuc

©2019 Bloomberg L.P.