Jun 7, 2023

Mystery Bet Before SEC Crypto Crackdown May Mint Trader Millions

, Bloomberg News

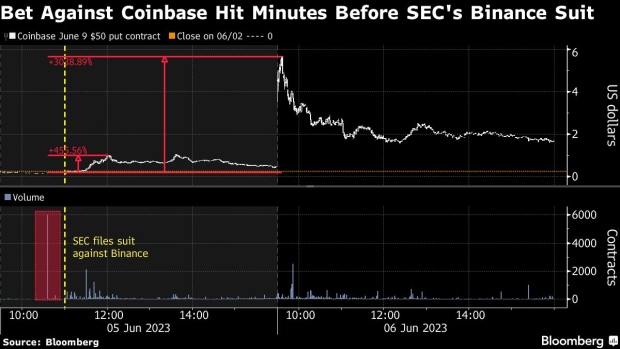

(Bloomberg) -- Less than a half hour before US regulators cracked down on a key crypto exchange, an options trader made a short-term bet against Coinbase Global Inc. that may have netted them millions of dollars.

At 10:36 a.m. on Monday, a block of 4,806 contracts of Coinbase $50 puts expiring Friday hit the tape, when the stock was at $61.77. Roughly 24 minutes later, the Securities and Exchange Commission announced that it was suing Binance Holdings Ltd, sparking a selloff across the crypto universe.

By noon in New York, Coinbase shares had fallen nearly 12% and the options, which had been bought for 18 cents each, traded for as much as $1 — a gain of almost 460% if sold at the peak.

Read more: SEC Sues Binance and CEO Zhao for Breaking Securities Rules (2)

The already profitable bet became even more lucrative on Tuesday after the SEC announced a separate suit again Coinbase itself.

Shares of the cryptocurrency exchange tumbled as much as 21% at the open of trading, driving the value of the put options to $5.65 each. The move means a trader could have potentially turned a $86,500 investment — the sum spent on buying the puts — into a windfall of as much as $2.6 million in less than day.

The prescient Coinbase trade comes just days after a mystery trader placed a large bullish bet on natural gas pipeline operator Equitrans Midstream Corp. ahead of language supporting the company’s project being inserted into the debt-ceiling bill, raising questions about whether details had leaked.

Read more: Mystery Trader’s Debt-Ceiling Windfall Sparks Insider Concerns

©2023 Bloomberg L.P.