Oct 11, 2020

Nasdaq-Like Valuation No Deterrent for Poland’s New Top Stock

, Bloomberg News

(Bloomberg) --

Poland’s newest stock listing is set to become the largest company on the country’s main exchange, highlighting investor demand for technology exposure as the Eastern European nation is introduced to Nasdaq-level valuations.

Allegro.eu SA is set to start trading in Warsaw on Monday, after the firm and its private-equity investors priced the 9.2 billion-zloty ($2.4 billion) IPO at the top end of a marketed range, cashing in on soaring demand for digital sales as consumers stuck at home indulge in virtual retail therapy.

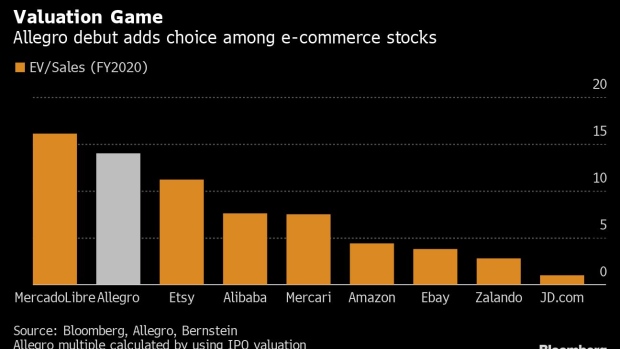

Analysts at Bernstein estimate Allegro’s enterprise value to earnings before interest, taxes, depreciation and amortization to be about 37, above the likes of Amazon.com Inc and Alibaba Group Holding Ltd, but below MercadoLibre Inc. and European fashion retailer Zalando SE, according to data compiled by Bloomberg.

“Allegro was priced close to global technology leaders as it’s already one of the biggest e-commerce companies in the world, which bring interest of many funds that accept higher valuations, given oversupply of the capital,” Haitong analyst Konrad Ksiezopolski said in emailed comments. “E-commerce is a winning industry during the pandemic, which should help the stock. Time will show the impact from competition of Amazon or AliExpress, which is a real test of Allegro’s valuation.”

The company is betting on the continued expansion of online shopping in Poland, a market of 38 million people and one of the European Union’s most resilient economies. Allegro is touting lower fees, a loyalty program, a high number of local merchants and market recognition to fend off competition. Amazon.com Inc. is still selling its products to Poles from Germany, while China-based AliExpress relies on lengthy shipping processes.

A new wave of coronavirus infections in Poland may also end up benefiting the firm, further accelerating the switch to online purchases.

Bernstein analyst Aneesha Sherman expects Allegro to have plenty of opportunities to expand to broader Eastern European markets, which are more fragmented and easier to scale up. Still, the company hasn’t announced such plans, saying that it wants to keep its focus on Polish consumers.

“Allegro provides high exposure to the fast-growing Polish e-commerce market and draws comparison to Amazon, which may be an attractive investment option for foreign investors, who took up most of the shares in offering,” Jaroslaw Niedzielewski, head of investments for Investors TFI mutual funds, said in an email.

“Local investors saw Nasdaq-level valuations in an IPO for the first time,” Niedzielewski said. “But their allocation is much below expected weight of Allegro in WIG20 index, which should trigger more buying.”

The transaction valued Allegro at $11.2 billion, which makes it the country’s largest listed company and likely to be added swiftly to major equity indexes. Inclusion in Warsaw’s WIG20 benchmark, likely to happen after the market closes Wednesday, and its anticipated addition to MSCI gauges at a later date may also fuel demand. The Polish benchmark’s current leader is another lock-down winner, game developer CD Projekt SA.

While fellow online shopping emporium THG Holdings Ltd. posted one of the best first-day pops in London for at least two years in September, floats on European exchanges have fared less well over the past two weeks. Military supplier Hensoldt AG, Russia’s state-owned tanker operator Sovcomflot OAO, Lithuanian electric utility AB Ignitis Grupe, camper-van maker Knaus Tabbert AG and China Yangtze Power Co. all slumped in their debut sessions.

The Warsaw Stock Exchange delayed Allegro’s opening by 15 minutes to avoid any potential overflow of its trading system, as a substantial number of shares in the IPO were sold to a fragmented group of retail buyers.

©2020 Bloomberg L.P.