Oct 22, 2019

Naspers Offshoot Orders Up $6.3 Billion of Takeout Food

, Bloomberg News

(Bloomberg Opinion) -- Tuesday’s dramatic hostile counter-bid for the British internet takeout company Just Eat Plc arrived almost fully baked. The assailant, the European offshoot of South African tech giant Naspers Ltd, is throwing the prospect of cash at Just Eat’s shareholders to persuade them to ditch an all-share merger deal with Dutch rival Takeaway.com NV.

The new offer isn’t that tempting. It needs a big dollop of dessert to make it irresistible.

Naspers listed the bid vehicle, Prosus NV, in Amsterdam last month and analysts had expected it to gatecrash. But the 4.9 billion pound ($6.3 billion) cash bid looks mean as far as takeovers go. It equates to a low premium of 12% above Just Eat’s price before the Takeaway.com talks emerged.

True, the Prosus offer is superficially better than the Takeaway.com merger. The latter deal would give Just Eat shareholders just over half the combined company, roughly in line with the duo’s average relative market values in the three months before discussions leaked. The upside would be split almost equally between each side’s investors. But there wouldn’t be much to share. Takeaway.com envisaged just 20 million euros ($22 million) of cost savings annually after four years. The governance was a bit of a fudge with board seats handed to both sides.

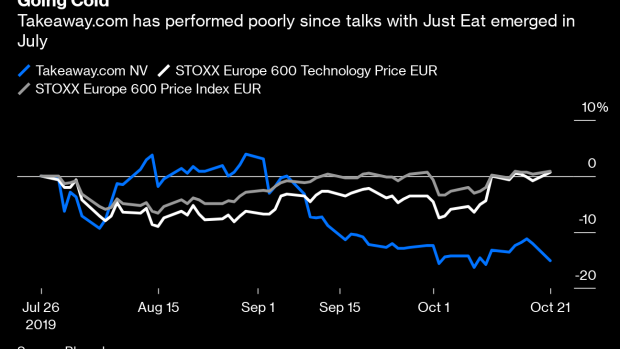

Moreover, Prosus’s premium is arguably higher than it looks. As Prosus points out, the internet sector’s shares have fallen in recent months. Takeaway.com is down 15% since the Just Eat talks emerged in July. If there were no negotiations and Just Eat shares had tracked its peer, its shares would be trading at about 540 pence. Prosus’s hostile offer adds 31% to that — that’s a more conventional-sized takeover top-up.

But the offer still isn’t high enough. Many of Just Eat’s top shareholders are also invested in Takeaway.com. For them the precise terms of the existing merger plan don’t matter too much. They may have liked the idea of crunching their holdings into a single big player they could hold over the long term. Forgoing that opportunity by cashing out demands a better than average premium.

With $5.7 billion of net cash and billions of dollars of listed holdings, Prosus can afford to go higher. Its offer ascribes Just Eat an enterprise value of 3.8 times estimated 2020 sales, as shareholder Cat Rock Capital Management LP notes. Takeaway.com’s trading multiple is 8.3 times, although its markets are less competitive.

Just Eat’s expected 394 million pounds of operating profit for 2023 would indicate a 7% post-tax return for Prosus from the deal. That’s in line with the target’s cost of capital. Add cost savings and the returns would probably be higher, which would justify paying more.

It’s hard to see how Takeaway.com, with a market value of just 4.5 billion euros, could outbid Prosus. Nor is it clear that another tech giant might want to wade in. But shareholders have leverage just from saying no. They should back their board in demanding more before recommending a full takeout.

To contact the author of this story: Chris Hughes at chughes89@bloomberg.net

To contact the editor responsible for this story: James Boxell at jboxell@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Hughes is a Bloomberg Opinion columnist covering deals. He previously worked for Reuters Breakingviews, as well as the Financial Times and the Independent newspaper.

©2019 Bloomberg L.P.