Oct 27, 2021

Natale's severance, promotions and $4,000 cheque: 3 nuggets from Rogers' court filings

The court may not have a choice but to accept what Mr. Rogers has done: Lawyer

As the fight for control of Rogers Communications Inc. (RCI) moves from the boardroom to the courtroom, below are a few interesting details from a court filing made Tuesday by Edward Rogers -- who’s locked in a power struggle over the company’s board of directors, including whether he’s the legitimate chair -- that highlight how fraught this battle has become. The claims by Mr. Rogers have not yet been tested or proven in court, and John MacDonald (who RCI says has standing as the company’s chair) said in a statement Tuesday that Mr. Rogers’ has presented a “one-sided view of events.”

New Rogers cable head? - Part of Mr. Rogers' planned management shakeup included appointing Robert Depatie, a company director and former CEO at rival Quebecor Inc., to Rogers' senior executive team to run the company's cable division as its chief operating officer. Depatie would also have to resign as a company director to take on the management role, according to minutes from a board meeting included in the court filings. As well, Dave Fuller would been promoted to run Rogers' wireless business as chief operating officer from his current role as president of the division.

A research note by TD Securities Analyst Vince Valentini on Thursday said it was a "relief" to see Mr. Rogers had his eye on a group of credible executives.

"We are pleasantly relieved to see that the Edward Rogers camp had an arguably credible plan to not only replace key members of the senior management team, but also to ensure a smooth (and respectful) transition away from Joe Natale as CEO during the critical deal-approval process," Valentini said in the report.

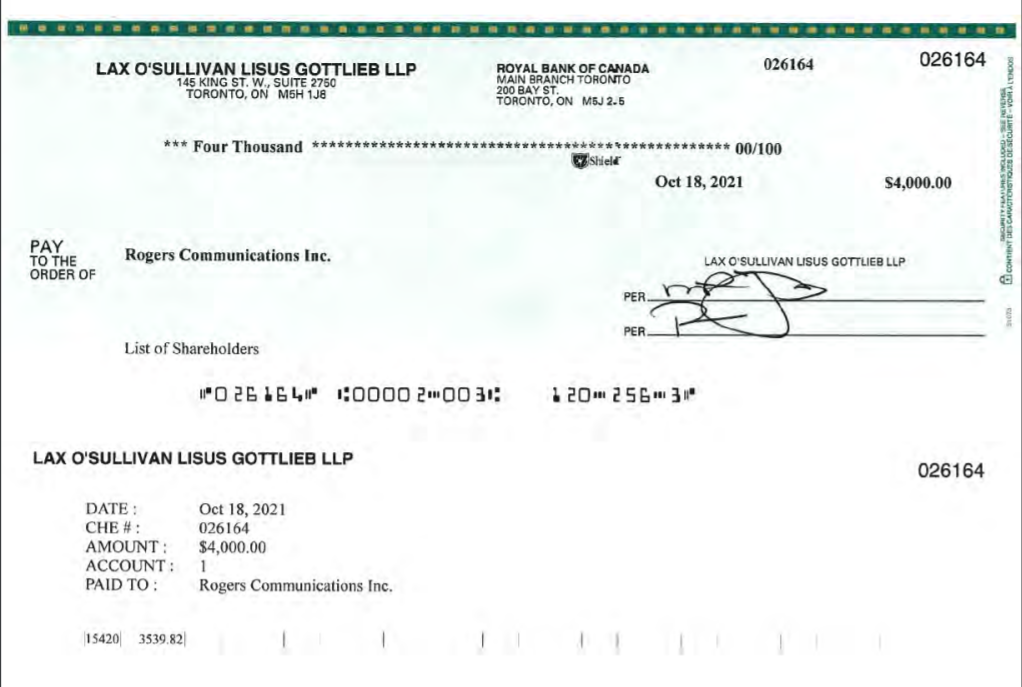

A $4,000 cheque - After getting his management changes rebuffed, Mr. Rogers sought on Oct. 4 to get a list of major RCI shareholders from the company. Rogers delayed its response for a week, stating technical difficulties. Fasken Martineau DuMoulin LLP, Rogers' legal counsel, told Mr. Rogers he would have to pay an additional $4,000 to obtain Rogers' shareholder records on top of the $1,000 that he already submitted.

The additional payment was necessary as Fasken said that $1,000 was "not reasonable relative to the cost for [Rogers] to obtain and provide these lists." A separate affidavit filed by Wenny Lai, a legal assistant at McEwan Cooper Dennis LLP, details the time-consuming efforts that the law firm took to send an associate to Rogers' legal counsel to pick up the shareholder list while abiding by COVID-19 guidelines, a process that was described by one Fasken lawyer as "a game of cat and mouse".

Eventually, the additional payment was made, the shareholder list was tracked down following a search of Rogers' Vancouver and Toronto offices, and Mr. Rogers obtained the records on Oct. 20.

The exit package - In a presentation to the company's board on Sept. 22 about his desire to dismiss Chief Executive Officer Joe Natale in favour of (now-ousted) Chief Financial Officer Tony Staffieri, Mr. Rogers initially suggested Natale receive a total of $51 million in severance and unvested equity, including a $10-million bonus, half of which would be paid upfront and the rest once the deal to acquire Shaw Communications Inc. closed. If Rogers' shares climbed to $125 within five years (as the company modeled), Natale's stock would be worth approximately $142.1 million, the filings show, giving his severance a total value of $171.3 million.

A proposed package was later designed to include a $4-million bonus upon completion of the Shaw deal, plus a $20-million lump sum as part of a consulting agreement between Natale and the company.

By comparison, if Staffieri were to have been promoted to the CEO position, it was proposed that he would have nearly doubled his annual base salary to $1.35 million, while his long-term incentive compensation would rise to $7.5 million from about $2 million, and his executive allowance would have quadrupled to $100,000.

Editor’s note: An earlier version of this post included incorrect exit package figures. BNN Bloomberg regrets the error.