May 24, 2019

Natural Gas Now Beats Coal, Even in West Virginia

, Bloomberg News

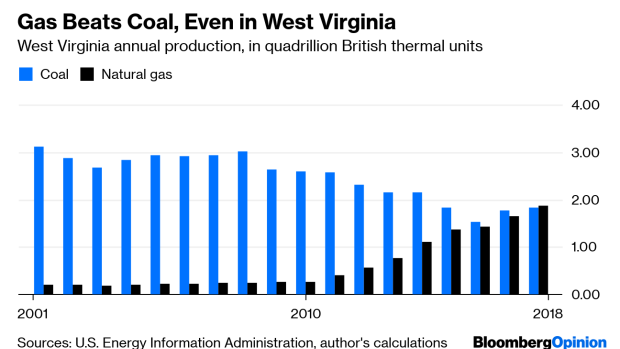

(Bloomberg Opinion) -- We appear to have quietly passed another landmark in the transformation of U.S. energy production. For the first time ever, the famously coal-centric state of West Virginia last year produced more natural gas, as measured by energy content, than coal.

West Virginia hasn’t been the biggest coal-producing state for a while; Wyoming, which passed it back in the 1980s, now mines more than three times as much of the stuff each year. But Wyoming gets almost all its coal from surface mines, while most of West Virginia’s comes from more-labor-intensive underground mines, so it remains the biggest coal-employing state by a wide margin. And despite its recent fracking- and horizontal-drilling-enabled natural gas boom, which has pushed it up to seventh place among the states in gas production, don’t expect West Virginians to embrace the shift to a natural-gas-fueled economy just yet. As Bill Raney, president of the West Virginia Coal Association, told the weekly State Journal late last year:

They’re counting on that (natural gas plants) to be a good replacement for coal plants which we do not think is true at all because when you have a coal-burning plant you’ve got a coal mine — at least one, probably more than one — that’s got 200 to 250 coal miners that are making $80,000-$90,000 a year. When you have a gas plant you have a gas well behind it and there’s no one there.

Actually, according to the Bureau of Labor Statistics, there were more people working in oil- and gas-related jobs in the state last fall than in coal mining, and a lot of them were making $100,000 a year. But that was only because of a presumably temporary spike (to 15,543 jobs in September 2018 from 1,802 a year earlier) in oil and gas pipeline construction work. Apart from that, there were 14,236 people employed in coal mining and support activities in West Virginia in September, compared to 5,778 in oil and gas extraction and support activities, and average pay was about 16% higher in the former than in the latter.(2)

The new pipelines being built will make it possible to transport more West Virginia gas to other states, where most of it will be burned to produce electricity. West Virginia, though, still generated 92% of its electricity from coal in 2018, the highest share of any state. A court ruling late last year did clear the way for the state’s first major natural-gas-burning power plant (to be built on the site of a former coal mine, of course), but the state’s leaders clearly have mixed feelings about the natural gas transition, given how slowly they’ve been going about it.

Nationwide, coal’s share of electricity generation was 27% in 2018, down from 48% a decade before. For all the understandable excitement about the rise of wind and solar power, it is the gas-drilling boom that has been responsible for most of that decline. (I left nuclear and hydroelectric, the other two main sources of electricity in the U.S., off the below chart because their generation numbers haven’t budged much.)

Natural gas accounted for 35% of U.S. electricity generation in 2018, up from 21% in 2008. Burning it generates much less in the way of climate-warming carbon dioxide and air-quality-reducing pollutants than burning coal does. But unlike wind, solar, hydroelectric and nuclear power, it still does generate carbon dioxide — and natural gas, aka methane, is itself an even more potent if shorter-lived greenhouse gas. Getting it out of the ground by pumping sand and water in raises other environmental concerns, and there are those who question whether these techniques are even financially sustainable, given that the fracking industry as a whole is still spending more cash than it’s bringing in. The natural gas boom of the past decade has been spectacular, and on balance I think it’s been a positive development. But there are reasons even for those of us who don’t hail from West Virginia to be ambivalent about it.

(1) Why am I citing September data in May? Because it's from the Quarterly Census of Employment and Wages, which provides much more granular information than the monthly state jobs reports but is released with a longer lag. Some fourth-quarter QCEW data were actually released last week, but it will be a couple of weeks before all of it is.

To contact the author of this story: Justin Fox at justinfox@bloomberg.net

To contact the editor responsible for this story: Brooke Sample at bsample1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Justin Fox is a Bloomberg Opinion columnist covering business. He was the editorial director of Harvard Business Review and wrote for Time, Fortune and American Banker. He is the author of “The Myth of the Rational Market.”

©2019 Bloomberg L.P.